-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Media General to buy magazine publisher, TV broadcaster Meredith

Meredith’s CEO Stephen Lacy will be the CEO and president. McDermott Will & Emery LLP and Cooley LLP are serving as legal advisors to the Des Moines, Iowa-based Meredith. Joseph H. Ceryanec will be the CFO.

Advertisement

He says no definitive answer on staffing can be provided this early but the merger “will result in higher employment levels in Des Moines over time”.

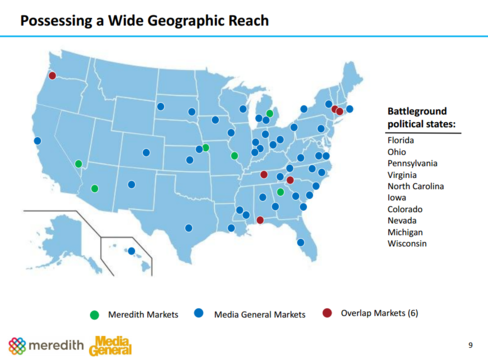

Together, they will become the No. 3 broadcaster in the US.

Wells Fargo analyst Marci Ryvicker said in a research note it was possible Media General would choose to spin off its magazine assets in the future. Media General’s current headquarters is 333 E. Franklin St.

“There’s a lot of uncertainty that goes with a station being sold, so I think to you will see some people leave rather than wait around to see who the new owner is going to be”, Hanley said. The two companies said they would swap or divest TV stations within six markets in order to receive approval from regulators for this deal.

Mell Meredith Frazier and E.T. Meredith IV – two major Meredith shareholders and descendants of the company’s founders – agreed to vote in favor of the sale.

Meredith’s shares were up 9.68 percent at $50.41 in afternoon trading.

The merger has been approved by the Board of Directors for both Media General and Meredith.

Meredith owns KCTV and KSMO in the Kansas City market.

This is the third acquisition Media General has announced since 2012, when it turned its focus toward TV station ownership and shed itself of its newspaper past. The deal that includes Meredith net debt of $772 million (as of June 30), values it at an enterprise value of some $3.1 billion.

Media General shares closed at $11.15 on the New York Stock Exchange on Friday, while Meredith’s shares closed at $45.94. Digital revenues are expected to exceed $500 million in the first full year of operations post closing.

Media General has formed a new holding company, which after closing will be named Meredith Media General. Since then, the company has purchased several television stations.

Instead Meredith seems to be prioritizing its TV and digital businesses. It assumed control of the Martha Stewart Living brands past year and then bought Mywedding.com, Shape and Selectable Media.

While the company has grown it has experienced some downsizing. In a restructuring move, it laid off 100 employees in April.

Advertisement

The executive said the publishing industry, like the TV station business, “needs to consolidate further”. Better Homes and Gardens followed a couple of decades later.