-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Federal Reserve officials cited worries that economic activity could be

“When they start to move, they’re going to move slowly”, likely raising rates by no more than 0.25 percent, Murphy said.

Advertisement

In a clear reference to the recent turmoil provoked by the downturn in the Chinese economy, the Fed noted that it is “monitoring developments overseas “, even as it said that the risks facing the U.S. economy are still “nearly balanced”.

A hike will depend on improvement in the labor market and increases in inflation. The Fed meets again in October and December.

There was one dissenter on the Committee, Lacker, who preferred to raise interest rates, and reflect the division of views around this decision.

The U.S. Federal Reserve manages something called the Federal Funds Rate which dictates the cost of borrowing USA dollars for everyone.

While the Fed took a pass at hiking rates this time around, there remain several opportunities for the central bank to lift rates this year. But, they added, “Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term”.

Ms Yellen was asked in the Fed’s news conference if protesters outside the meeting demanding low rates – and outside their last meeting at Jackson Hole – had affected the decision to leave interest rates unchanged. A drop in oil prices and a strengthening of the dollar since July will only hold inflation back further.

Following the Fed decision, rates futures placed an 18 percent chance that the USA central bank would end its near-zero interest rate policy in October, down from 41 percent Thursday morning, according to CME Group’s FedWatch program.

THE New Zealand dollar spiked to a two-and-a-half week high after the Federal Reserve kept interest rates on hold.

“Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability”, the Fed statement said.

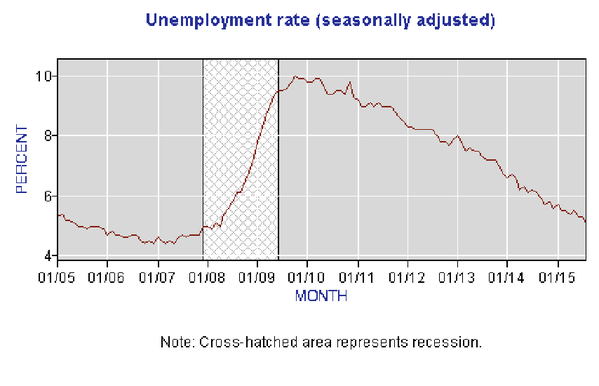

“Given the global headwinds, the last thing we need right now was a hike in rates and any kind of hawkish projections”, said Brian Dolan, head market strategist at DriveWealth in Chatham, New Jersey. It raised its expectations for economic growth this year to 2.1% from 1.9%, and it lowered its projection for the unemployment rate by the end of the year to 5%. The Fed announced in 2012 that it would keep rates near zero until the unemployment rate fell below 6.5 percent.

Advertisement

Update as of 4:45 a.m. EDT: European markets were subdued Friday morning as the U.S. Federal Reserve’s comments about the state of the global economy and market volatility hurt investor sentiment. The Fed’s forecast still foresees inflation accelerating to a 1.7 percent increase next year, still below its 2 percent target.