-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

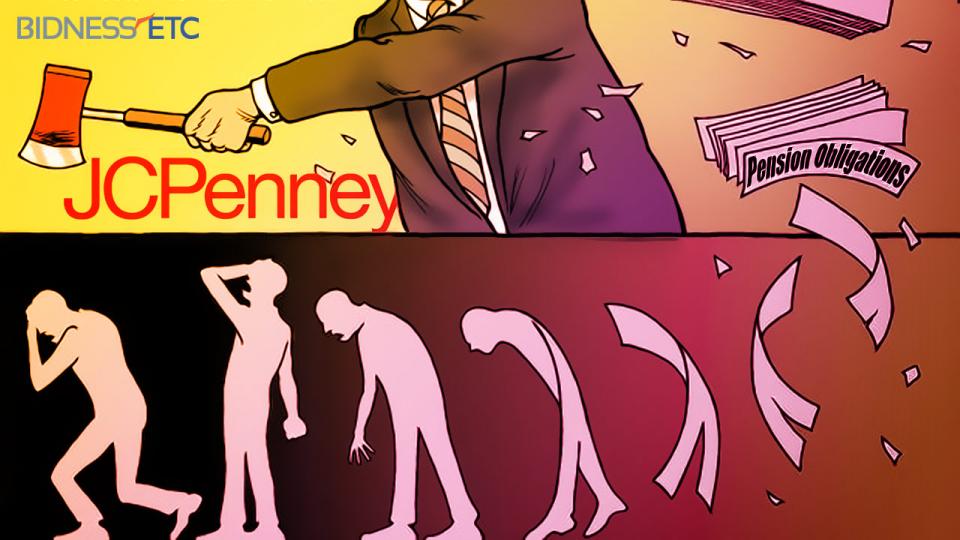

JC Penney Seals $5B Pension Buy

J.C. Penney on Friday said it has cut its $5 billion pension obligation by more than 25 percent completing a lump-sum offer to 12,000 retirees and buying annuities for 43,000 retirees. It is a win-win plan for both the parties; while for companies this is an approach to hedge against any possible headwinds in investor returns or a potential surge in expenditures, for insurance corporations, this is an easy plan to inject billions in asset value. General Motors and Verizon Communications also have shifted these future costs to insurers in recent years. About 25,000 of those participants elected to take the lump sum, and the company made a total of $439 million in payments in December 2012. J C Penney has said the payments are due in November once the amount is settled in full.

Advertisement

Moreover, around 1,900 previous representatives who have conceded vested advantages chosen to get protuberance wholes. A deal reached with Prudential calls for the purchase of a group annuity contract that will settle a substantial portion of J.C. Penney’s remaining retiree pension benefit obligations, according to a statement by the company.

The Texas-based midrange merchandiser joins other companies that recently have been unloading future pension liabilities to insurers seeking to boost their assets. The transfer will leave the company’s remaining pension plan overfunded.

We rate PENNEY (J C) CO (JCP) a SELL.

Advertisement

Retirees will continue to receive monthly checks from Prudential when the switch is completed by the end of the year or early next year. For the second quarter of 2014 the company reported an increase of 6% in comparable store sales.