-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

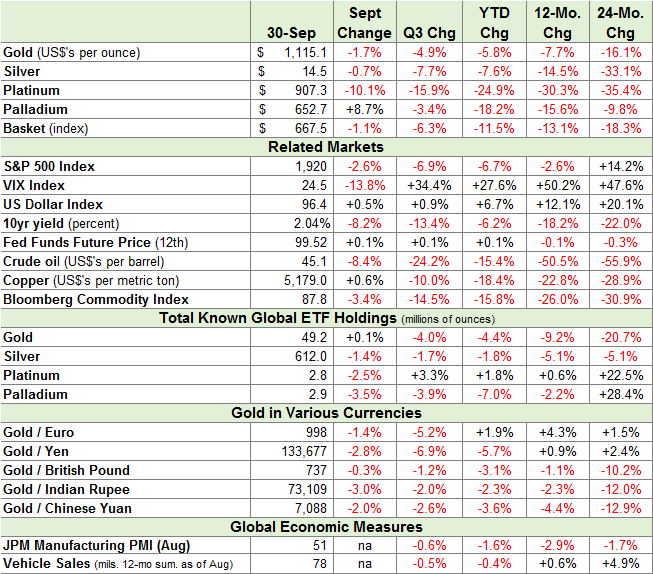

Gold futures fall to Rs 26507 per 10 gms

Spot gold eased 0.1 percent to $1,143.80 an ounce by 0952 GMT.

Advertisement

Silver fell as much as 3.2% before recovering slightly to trade down 2.7% at $15.63. The metal climbed to $1 151,20 in the previous session, its highest since September 24.

Traders awaited minutes of the last Federal Reserve meeting.

Gold prices had followed silver and fallen almost $10 at the lows but a quick wave of buying the last 10 minutes helped it rebound to unchanged. Although traders have said that the likelihood of a rate rise has been factored into the current price of gold, the Fed’s minutes could offer more detail about the pace and timing of the USA central bank’s plans, which could influence metals. “What the market will be looking for is, how close was the Fed to making a move in the September meeting, and how deep and detailed was the global turmoil discussion in that meeting”, said Rob Haworth, senior investment strategist for US Bank Wealth management in Seattle.

Gold rose towards its highest in almost two weeks yesterday, as more sluggish USA economic data supported the view that the Federal Reserve would delay a rate hike to next year. Analysts noted that gold continued to rise after the data released on Tuesday morning. The metal had earlier come under pressure from expectations that the Fed may raise interest rates this year, potentially lifting the opportunity cost of holding non-yielding bullion.

In futures trading, gold for delivery in far-month February next year was trading Rs 49, or 0.18 per cent down, at Rs 26,698 per 10 grams at Multi Commodity Exchange with a business turnover of 12 lots.

Advertisement

Platinum fell 1 percent to $931.74 an ounce and palladium dropped 1.2 percent to $688.70 an ounce.