-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

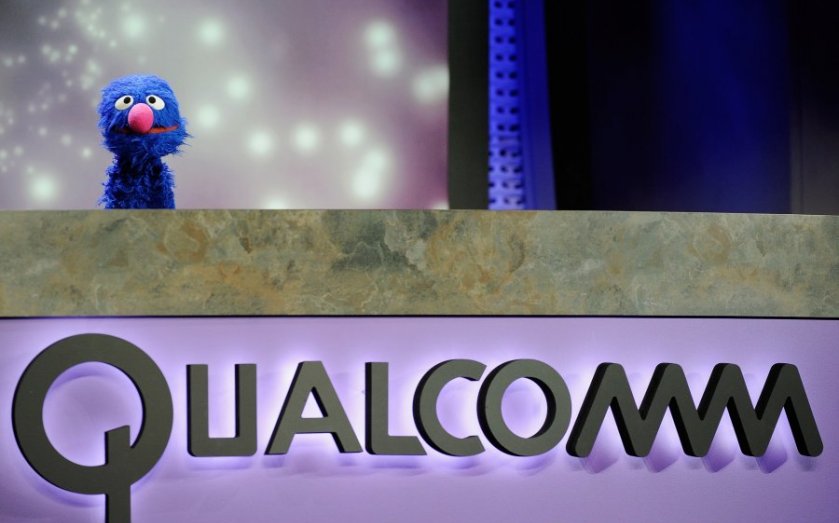

QUALCOMM Inc. (QCOM) Is Falling On Disappointing Q1 Forecast

It forecast per-share earnings of 80 cents to 90 cents and revenue of $5.2 billion to $6 billion, below estimates of analysts polled by Thomson Reuters for per-share profit of $1.08 and revenue of $5.79 billion. A few progress followed; Qualcomm said on Monday that it had reached a new worldwide licensing pact with ZTE Corp., one of China’s major smartphone makers. Qualcomm sees revenues between $5.2 billion and $6 billion, compared to the $5.74 billion consensus.

Advertisement

The company’s shares fell almost 6 percent in extended trading on Wednesday.

Fiscal Q4 was the second consecutive quarter that Qualcomm’s earnings and sales have declined year over year.

Qualcomm was hurt also by customer Samsung Electronics Co Ltd’s 005930.KS decision to use an internally developed processor, instead of the Snapdragon chips, for its Galaxy S6 smartphones. As Apple and Samsung post sales gains with new phones that don’t use Qualcomm’s Snapdragon processors, smaller providers that use the chip are shipping fewer phones. GAAP EPS is expected to clock in at $0.62, falling near the midpoint of the company’s guided range of $0.51-0.76.

Underlying the difficulties its chip division is facing, chip shipments totaled 203 million in the recent quarter, down 14 percent from a year earlier, Qualcomm said. The chip biz said that since it struck the settlement deal with the Chinese government’s NDRC regulator, it has been fighting to recover payments from hardware vendors and licensees in China who were under-reporting the number of devices they sold and, in the process, short-changing Qualcomm on royalty payments.

In after-hours trading, Qualcomm stock was down more than 5%. The net income attributable to Qualcomm fell to $1.06 billion, or 67 cents per share, in the fourth quarter ended September 27 from $1.89 billion, or $1.11 per share, a year earlier.

Advertisement

Investors are still waiting for Qualcomm management’s full response to its change in fortunes. The results were at the high end of the range the company gave three months ago, EPS ex items of 75-95 cents and sales of $4.7 billion-$5.7 billion. In July, the company unveiled plans to cut its workforce by 15 percent, shook up its board membership and is said it was reviewing strategic alternatives, including a breakup.