-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Mortgage rates fall on volatility overseas – Scotsman Guide

The lower rates brought an incentive for prospective purchasers toward the end of the spring home buying season.

Advertisement

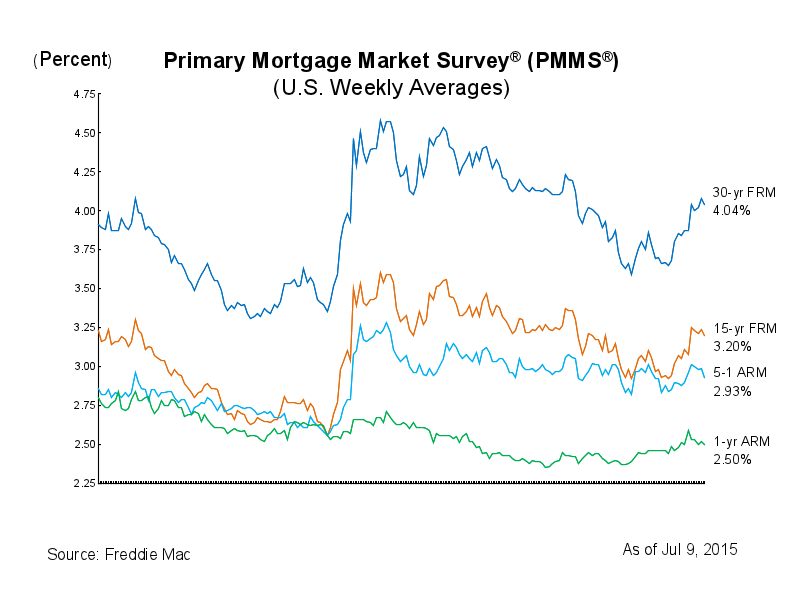

The 30 year fixed national average is 4.04%, and the 15-year fixed is averaging at 3.20%.

Mortgage rates stopped their upward trend and dropped back down due to global uncertainty, the latest Freddie Mac Primary Mortgage Market Survey said.

For loan amounts from $417,001 to $625,500, the rate for a 10-year, zero-cost ARM is 3.99 percent, compared to a 30-year fixed at no-cost at 4.25 percent.

The demand for the safety of US government debt pushes bond prices higher, and bond yields lower.

“Yields on Treasury securities declined this week in response to investor concerns about events in Greece and China”, says Sean Becketti, chief economist, Freddie Mac.

The average rate on five-year adjustable-rate mortgages fell from 2.99% to 2.93%.

For the second week in a row, and just the third time on record, the average rate for the jumbo 30-year fixed rate mortgage is below that of the conforming 30-year fixed mortgage. “In addition, the minutes of the June meeting of the Federal Open Market Committee suggest the Federal Reserve will proceed cautiously-monitoring events both overseas and in the U.S.to ascertain the appropriate moment to begin raising short-term interest rates”.

Advertisement

Current mortgage rates for this Thursday at the nation’s top lenders are mostly the same as yesterday’s report. The one-year Treasury-indexed ARM averaged 2.50 percent this week with an average 0.3 point, down from last week when it averaged 2.52 percent. With the average rate now at 4.14 percent, the monthly payment for the same size loan would be $971.04, a difference of $40 per month for anyone that waited just a bit too long.