-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

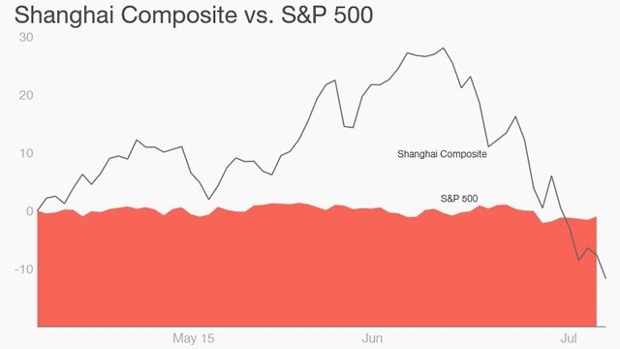

China’s stock market crash … in 2 minutes

Chinese companies could issue shares of stock and use the proceeds to pay down debt. About 60 companies resumed trading on Friday.

Advertisement

The city’s benchmark Hang Seng Index ended up 3.73 percent, or 876.23 points, at 24,392.79 points on turnover of HK$212.07 billion ($27.35 billion) after suffering heavy losses on Wednesday.

And not only have China’s stocks fallen, all the government’s attempts to save the markets have begun to backfire.

Hong Kong’s stock exchange closed for four days after the Black Friday global market crash in October 1987.

Premier Li Keqiang said China would make more targeted policy changes to support the economy, although he did not comment on the stock market.

As the losses have deepened, though, worries have increased and officials have taken direct action to stem the selling. Regulators have banned major stockholders from selling stakes in listed companies, suspended initial public offerings, and restricted short selling.

The country’s 111 major state-owned enterprises were barred from selling shares in their listed subsidiaries by the state-owned Assets Supervision and Administration Commission, which oversees them.

It’s actually made things worse.

The rally also provided some support to regional markets and commodities, which had earlier this week been hammered by fears about a spillover effect beyond the mainland.

An investor adjusts his glasses as he looks at a computer screen in front of an electronic board showing stock information at a brokerage house in Fuyang, Anhui province, China, July 9, 2015. The steep decline comes after a spectacular rally that sent the Shanghai index up 150 percent in the previous 12 months despite slowing growth in the world’s second biggest economy.

Chinese shares staged a strong two-day rebound after moves by the government to bolster the market.

At the same time, fund managers like Wilson say the volatility and selloff is making the Chinese market more attractive for long-term investors, even if the market has not hit bottom yet. According to Chinese media, of the about 2,800 companies listed on the Shanghai and Shenzhen exchanges, around 1,400 have halted trading of the shares. However, all these measures failed to instill confidence in retail investors, who constitute over 8 per cent of total Chinese stock market.

If you have a 401(k), there’s a good chance you have a few. Some investors mortgaged their homes to get money to buy stocks. The percentages, though, are small.

The world’s second-largest equity market now has more than 90 million individual investors, which is higher than the number of Communist Party members.

Other economists disagreed that the tumult in the stock market was likely to have a big impact on consumption.

The trend was in reverse between the third quarter last year and the first quarter this year, during which the stock market gained more than 100 per cent.

Meanwhile there have been concerns that the crisis on the stock markets might be starting to infect the property market.

Advertisement

Analysts also fret that China’s economic engine could sputter further, causing problems generally for economies around the globe and specifically for USA exports to China.