-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

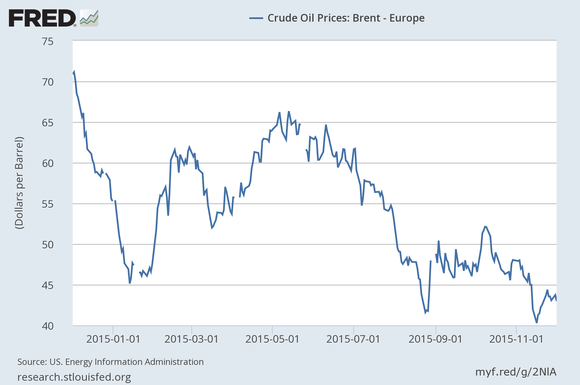

USA crude and brent oil prices continue to slide after Opec decision

Analysts said that OPEC would likely maintain its production around current levels of 31.5 million barrel per day and that a decision on how to handle new volumes expected to come to the market once western sanctions against Iran are dropped would be delayed until the group’s next meeting in June 2016. Prices declined 1.9 percent to $39.23 at 12:23 p.m. London time.

Advertisement

Further more, the transcript disclosed that if OPEC cut its actual production back to 30 million barrels a day-an agreed upon ceiling that the cartel consistently ignores-then demand would outpace the world’s production by 800,000 barrels a day.

Oil stayed below $40 a barrel in Asian trade this morning after the OPEC cartel decided against slashing high output levels and traders turned their attention on a U.S. central bank meeting next week.

In addition, the glut of oil on the global market continues to increase – exerting downward pressure on oil prices.

Heading the country’s delegation to the Organisation of Oil Exporting Countries ministerial meeting in Vienna on Friday, Al Mazrouei predicted a growth in demand by 1.3 million barrels per day in 2016.

Wednesday marked one of the week’s worst days for crude oil futures, as a strong US dollar, inventory data from the US Energy Information Administration (EIA), and speculation of OPEC keeping its production rates constant, weighed on the commodity future.

The Saudis already resisted cutbacks a year ago, a strategy calculated to put higher-cost outside competitors – like USA shale oil producers – out of business.

Friday’s news pushed oil prices down, with the US benchmark rate sliding 2.7 percent on the day to $39.99.

THE QUOTE: “No one in the energy patch is willing to support the price (of oil) and if they aren’t willing, the price will keep dropping”, said Mizuho Securities Chief Economist Steven Ricchiuto. Year-to-date, Brent oil price has fallen 25.41 per cent. With persisting disagreement between Saudi Arabia and Iran, any ceiling on Opec’s crude production seems unlikely. The US benchmark following ETFs like the United States Oil ETF (USO) and the ProShares Ultra Bloomberg Crude Oil ETF (UCO) also fell in the direction of US crude oil prices during the same period.

Because of ongoing oversupply, analysts said that prices would fall further.

Advertisement

“Having said that I don’t know if the price will be at 40, 45, 50, 60” USA dollars per barrel, he added. In case no changes are made, then chances are that crude oil prices will be pushed lower, which is great news for customers from all around the world.