-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Micron Technology, Inc. 60.3% Potential Upside Now Implied by Cowen

Regarding this latter factor, Micron’s production growth (or “bit” growth) has fallen behind its competitors due to the ongoing technology transitions-a transient situation.

Advertisement

NASDAQ:MU) disclosed its first quarter fiscal 2016 (1QFY16) earnings after yesterday’s closing bell.

On Wednesday’s pre market, shares in Bank of America Corp (NYSE:BAC) recorded increase of 0.59% at $17.18.

Both measures were in line with Micron’s guidance three months earlier, but sales missed analyst expectations for $3.46 billion.

Micron reported operating income of $232 million, which decreased from $1.085 billion reported in the year-ago quarter. The company forecast fiscal second-quarter sales of US$2.9 billion to US$3.2 billion and a loss of US$0.05 to US$0.12 a share, according to a presentation posted on its Web site. It has underperformed the S&P500 by 42.79%. The stock now has an average rating of “Buy” and a consensus target price of $22.21. This means that 61% of the ratings are positive. The highest target is $43 and the lowest is $10 according to Thomson/First Call. Cowen have set a target price of 22 Dollars on its stock.

MU has been the topic of a number of other reports. 15 have rated it as a strong buy.

It’s a new way to trade stocks with a 91% to 100% success rate, and earn between 8% and 199% in as little as 14 days. Pacific Crest maintained the rating on October 2. Shares are down 58% for the year. Baker Avenue Asset Management bought a new stake in Micron Technology during the third quarter valued at about $945,000. The net result was for 1 transaction, worth $80,002.

Zacks, which offers products catering to retail investors, offers an average broker rating (ABR) which simplifies often complicated brokerage recommendations.

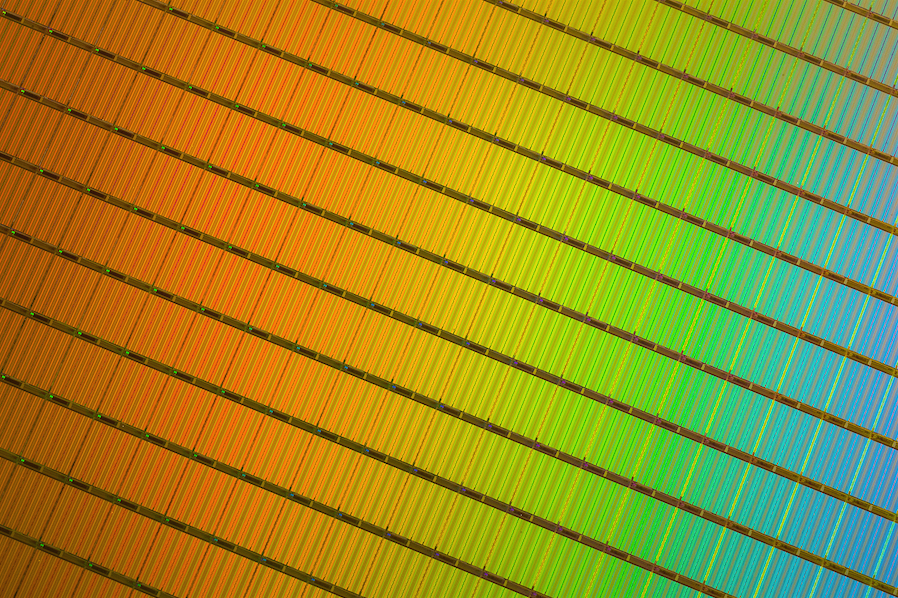

Micron Technology Inc and its subsidiaries manufactures semiconductor systems. The company offers DDR4 and DDR3 DRAM products for computers, servers, networking devices, communications equipment, consumer electronics, automotive, and industrial applications; mobile low-power DRAM products for mobile phones, tablets, embedded, computers, and other mobile consumer device applications; DDR2 DRAM, DDR DRAM, GDDR5 DRAM, SDRAM, reduced latency DRAM, and pseudo-static DRAM products for use in networking devices, servers, consumer electronics, communications equipment, computer peripherals, automotive and industrial applications, and computer memory upgrades; and HMC semiconductor memory devices for use in networking and computing applications.

Advertisement

The stock’s valuation, price to earnings ratio or P/E ratio stands at 5.76. The Firm operates in four divisions: Compute and Networking Business Unit (CNBU), which includes DRAM and NOR Flash products; Mobile Business Unit (MBU), which includes DRAM, NAND Flash and NOR Flash products; Storage Business Unit (SBU), which includes NAND Flash components and Solid-State Drives (SSDs), cloud and removable storage markets.