-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

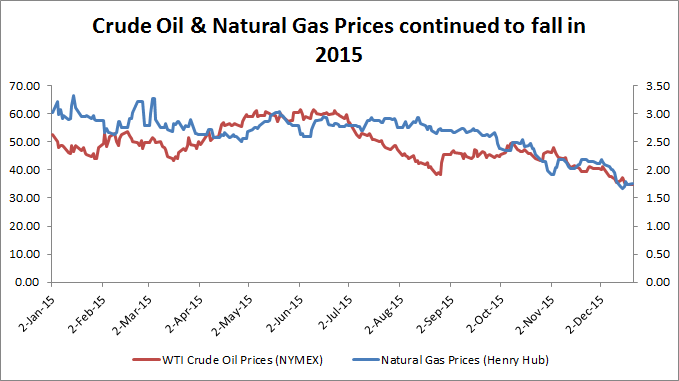

Brent, WTI crude prices drip to new 12-year low

WTI and Brent traded down by more than 2 percent during midday trading on Monday, as the markets continue to digest the worrying economic news coming out of China.

Advertisement

Shayne Heffernan Funds Manager at HEFFX holds a Ph.D.in Economics and brings with him over 25 years of trading experience in Asia and hands on experience in Venture Capital, he has been involved in several start ups that have seen market capitalization over $500m and 1 that reach a peak market cap of $15b. That’s on top of a loss of 24 percent for 2015. The wild gyrations and the haphazard response from the Chinese government has created an atmosphere of instability.

The index fell 1 per cent on Monday as energy stocks slumped on the back of another plunge for crude oil, pushing the index deeper into bear market territory. And that happens in multiple ways. “Worry about China has led to greater pessimism about the demand picture”. That is already starting to show up in the data. Stocks in both the CSI 300, and the China A50, ended the day in positive territory.

China’s crude oil demand might grow by just 2% this year.

The weakness in crude oil prices during today’s trade is once again being fueled by speculation of depressed demand from the second-largest consumer of the commodity: China.

The most bearish view came from StanChart, which stated that the prices could drop to as low as 10/bbl. However, unlike Goldman Sachs, Morgan Stanley was reported to have said that the move to $20 a barrel would be largely driven by non-fundamental drivers, such as the rapid strength in the U.S. dollar-diminishing the attractiveness of the greenback-denominated futures contracts.

The problem is that oil is not $50 per barrel, and could be a long way from rebounding to that point.

“Investors were looking for fear and trepidation from producers but got agility and below-expected clarity instead”, according to Friday’s research note.

“Instead, producers spoke largely of their agility to spend within cash flow and… ramp up when needed”, the Wall Street bank said.

Prime Minister Narendra Modi met global oil and gas experts here last week to discuss ways of boosting investments in exploration and skill development in India at a time of low oil prices. Prices lost 30 per cent a year ago.

“OPEC is in the position whereby they can support lower-cost production rather than the higher-cost U.S. shale assets”.

Advertisement

Brent crude rose to a three-week high of US$38.91 a barrel on the 4 January as a effect of the Saudi-Iran geopolitical risk but these gains were quickly diminished due to concerns over economic slowdown.