-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

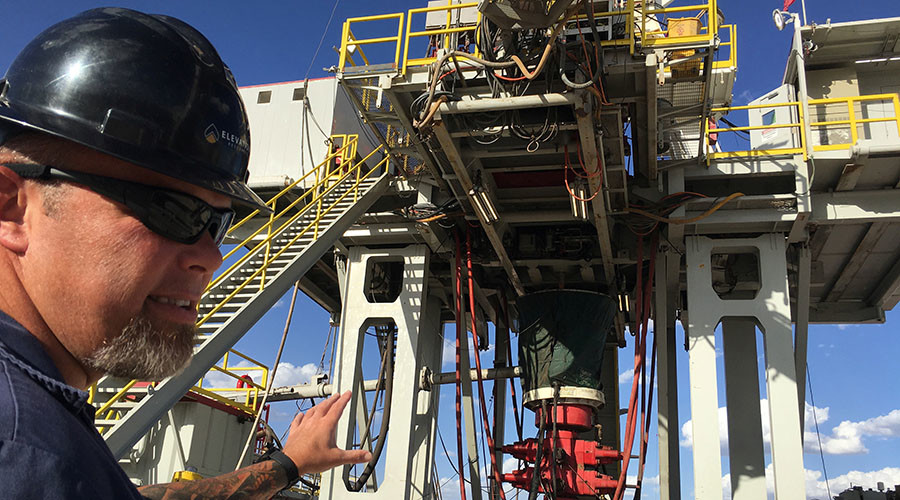

Oil climbs to 10-month high as falling U.S. supplies trim glut

USA crude’s West Texas Intermediate (WTI) futures fell 67 cents to settle at $50.56, after dropping $1 at the session low. The Energy Information Administration said Tuesday that domestic crude production in May averaged 8.7 million barrels a day, down about 1 million barrels a day from its peak in April a year ago.

Advertisement

Brent for August settlement gained as much as 35 cents, or 0.7 percent, to $52.86 a barrel on the London-based ICE Futures Europe exchange.

Traders said the price rises were largely a result of a drop in USA crude oil inventories.

“The softer tone across energy markets weighed on global equities which also saw their recent run of gains grind to a halt as growth concerns returned to the fore”, they added.

The commodity hasn’t settled above $51 since July 15, when it hit $51.41, according to the Oil Price Information Service.

U.S. crude futures were up 65 cents at US$51.01 a barrel, rallying earlier to US$51.27, the highest level since July.

USA crude stockpiles were down by 2.7 million barrels last week, marking a third straight week of declines and a report by trade group American Petroleum Institute (API) released after prices settled showed a higher-than-expected crude draw of 3.6 million barrels.

After starting Thursday, June 9, 2016, on a weak note, crude oil continued its decline during the day from the 11-month high reached on June 8.

With fundamentals both for and against higher prices, many traders and analysts say a price of $50-60 per barrel may be fair value.

Attacks have cut output to 1.6 million barrels per day, well below the budgeted-for 2.2 million barrels per day, heaping further pressure on an economy badly hit by the global fall in the price of crude since mid-2014.

Chances of output from Canada picking up in the near term remain slim as fires in northern Alberta, the country’s main oil producing region, resulted in at least two companies shutting down production facilities.

Yesterday, the Department of Energy had said the United States commercial stocks fell much more than expected in the week to June 3, fanning talk that demand is improving in the world’s biggest oil consumer.

Advertisement

Meanwhile, fuel demand has been on the rise, thereby indirectly helping lift oil prices.