-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

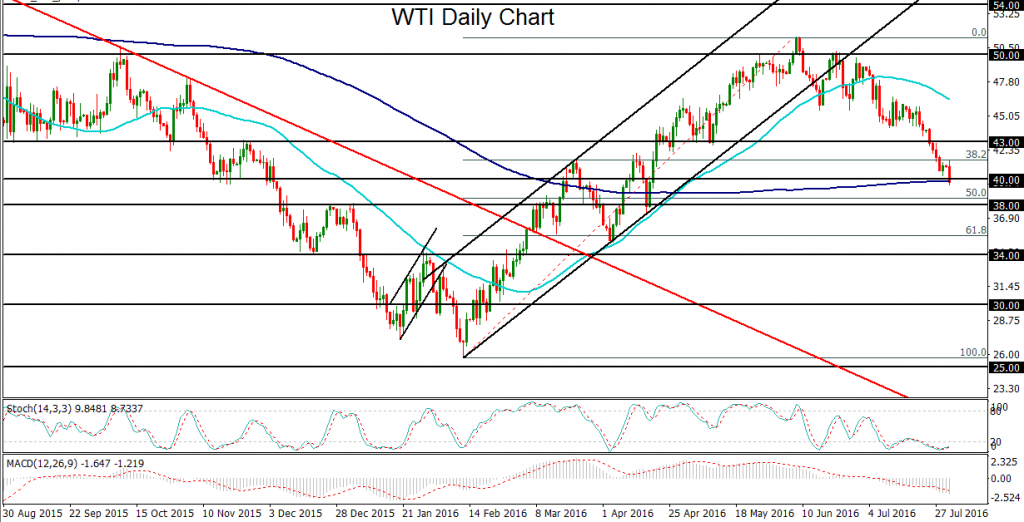

Oil climbs as U.S. gasoline supplies drop most since April

Other analysts said high crude and product output would continue to weigh on markets and that as a result, refiners were likely to reduce orders for new crude feedstock, affecting demand for oil.

Advertisement

Hot from the weakest month in a year in July, global oil futures started August on a similar note, losing 3%, falling under $US40 a barrel in NY, and dipping into bear territory. In the previous session, it rose 3 percent, after settling below $40 on Tuesday, the first time since April.

USA crude futures settled down more than 1 percent after initially rising over 2 percent, traders said.

The bearish bets have pulled the net long position for WTI down to its lowest level since February, Oil Price added.

“When oil topped $50 this year, everyone thought that’s the “go” signal and we’re just going to start adding rigs back and taking advantage of that”, said Stewart Glickman, head of energy research for S&P Global Market Intelligence, in an interview.

There may be indications of a pick-up in demand to help ease supply.

International Brent crude futures were trading at $43.39 per barrel, up 29 cents, or 0.7 percent, from their last close.

Crude stocks at the Cushing, Oklahoma, delivery hub fell by 1.12 million barrels, said the Energy Information Administration, the department’s statistical arm.

In early morning trading, the contract for the NY futures for September delivery fell to $39.90 before having a resurgence to get up to $40.80 U.S. at 10:15 a.m. ET. Total volume traded was about 26 percent below the 100-day average.

However, crude inventories increased by 1.4 million barrels against analysts’ expectations for a decrease.

The EIA said the 521.1 million barrels in the USA stockpile is more than 61 million barrels higher than it was a year ago and more than 150 million barrels above the supply figure two years ago.

Advertisement

The Bloomberg Spot Index, which measures the dollar against 10 peers, dropped to the lowest level since June 24, as the Japanese yen reached a three-week high on the government’s announced spending boost.