-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Crude oil is sliding

“We’d argue the consumer is more inclined to save an additional dollar (from cheaper oil) now than spend it”, the bank said.

Advertisement

A bigger-than-expected build in U.S. gasoline stockpiles last week proved more important to investors than crude storage numbers that came in three times below forecast on Wednesday.

Another supply challenge to watch is shale drilling in the U.S. Despite the plunge in oil prices, drillers have been stubborn about cutting production.

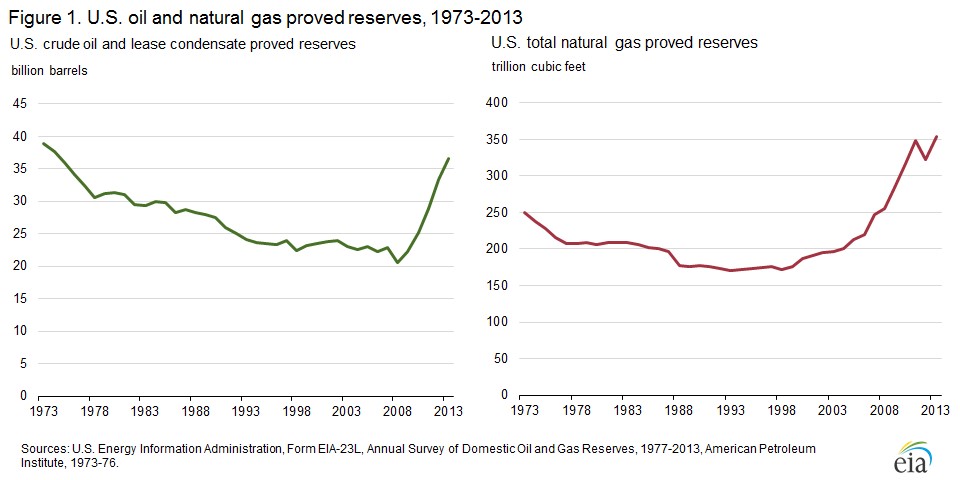

Consider that, according to the U.S. Energy Information Administration, U.S. crude oil production will average 9.5 million barrels a day in 2015 – up significantly from 8.7 million in 2014.

The expert stressed that oil demand will increase with low prices, and rising demand may push crude oil prices higher in the next two years.

Oil markets paused for a breather after prices tumbled about 20 percent in July because of a supply glut.

Brent, the global oil benchmark, was trading 24c higher at $49.76, after reaching a six-month low in the previous session.

US crude futures settled down 59 cents, or 1.3 per cent, at $45.15 a barrel, hitting a low last seen in March of $44.83.

Analysts say the slump may have further to go as U.S. refineries, which turned a record amount of crude into gasoline during July, typically slow down from August through October for maintenance. Government intervention in response to suspicious market activity arrested some of the declines, though CITIC Securities, the largest trader of its kind in China, saw net profit drop by more than 20 percent from June.

The dollar has picked up steam on expectations the Federal Reserve will raise US interest rates later this year.

US benchmark West Texas Intermediate (WTI) for September delivery was at $44.83, down from $47.12 a week ago, and on course for its eighth consecutive week of declines.

Advertisement

Goldman Sachs (NYSE:GS) estimates the global crude oversupply is running at 2 million barrels a day and storage may be filled by the fall, forcing the market to adjust, analysts including Jeffrey Currie said in a report dated Thursday.