-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

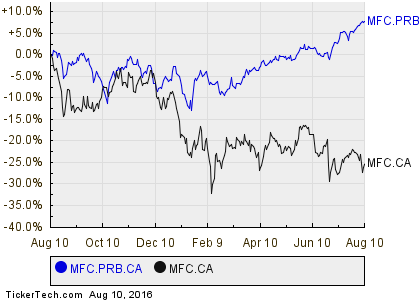

Brokers Update Target Prices On Manulife Financial Corp (NYSE:MFC)

The company has a market cap of $11.67B.

Advertisement

Fifth Street Finance Corp.is a specialty finance company that lends to and invests in small and mid-sized companies, primarily in connection with investments by private equity sponsors.

Regions Financial Corp (NYSE:RF) stock is now trading at about $9.30 and lots of rating firms seem to have a target price set on the stock. For the past 5 years, the company’s revenue has grown 3.3%, while the company’s earnings per share has grown 9.9%. Fiera Capital Corp now owns 19,277,178 shares of the company’s stock valued at $289,130,000 after buying an additional 241,884 shares in the last quarter. The insider owns 544,874 shares which have current market value of around $5067328.MCCRARY CHARLES D is another major inside shareholder in the company. The forecast of 13 polled investment analysts covering the stock advises investors to Buy stake in the company. It closed at $13.37, notching a gain of 0.75% for the day.

The stock’s 50 day moving average is 5.34 and its 200 day moving average is 5.17. Manulife Financial Corp (NYSE:MFC): During Thursdays trading session, Bulls were in full control of the stock right from the opening. The company reported $0.40 earnings per share (EPS) for the quarter, beating the Zacks’ consensus estimate of $0.36 by $0.04.

A number of Reuters analysts recently commented on the stock. During the same quarter a year ago, the company posted $0.44 EPS. These analysts have also projected a Low Estimate of $1.77/share and a High Estimate of $2.16/share.

Advertisement

The business also recently announced a quarterly dividend, which will be paid on Monday, October 3rd. The debt-to-equity ratio (D/E) was recorded at 0.65. The ex-dividend date of this dividend is Wednesday, September 7th. This represents a $0.56 annualized dividend and a dividend yield of 4.24%. Macquarie downgraded shares of Manulife Financial Corp. from an “outperform” rating to a “neutral” rating in a research report on Thursday, August 4th. The company’s net profit margin has achieved the current level of 17.4% and possesses 0% gross margin. FIG Partners raised Regions Financial Corp. from an “underperform” rating to a “market-perform” rating in a report on Sunday, April 17th. One analyst has rated the stock with a sell rating, thirteen have given a hold rating, eleven have assigned a buy rating and two have given a strong buy rating to the stock. For the next 5 years, Capital One Financial Corporation is expecting Growth of 4.4% per annum, whereas in the past 5 years the growth was 5.85% per annum. The most optimistic analyst sees the stock reaching $12 while the most conventional predicts the target price at $8. The Company is a holding company of The Manufacturers Life Insurance Company (MLI), a Canadian life insurance company, and John Hancock Reassurance Company Ltd. (JHRECO), a Bermuda reinsurance company. The Company’s segments, including Asia Division, Canadian Division, U.S. Division, and the Corporate and Other segment.