-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

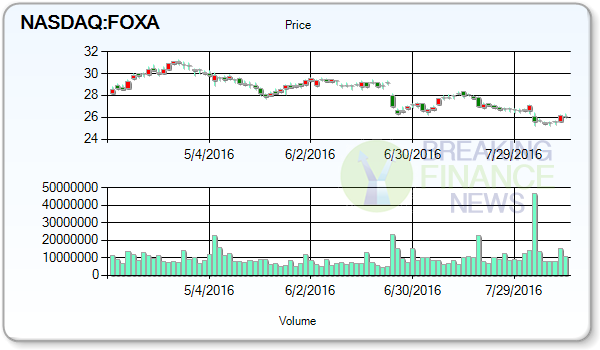

Jefferies Maintains Twenty-First Century Fox Inc to Buy with Price Target $32.00

(NASDAQ:FOXA) had its target price decreased by research analysts at Citigroup Inc. from $32.00 to $31.00 in a research note issued on Monday.

Advertisement

08/04/2016 – Twenty-First Century Fox, Inc. had its “buy” rating reiterated by analysts at Pivotal Research. The Company holds 1919.17 million shares outstanding. Recently, stock has been recommended as “BUY” from “5” and “0” given “OVERWEIGHT” rating for the company. (FOX) ended last trading session with a change of -0.26 percent. The pessimistic mood was evident in the company shares which never went considerably beyond the level of $26.815. Zurich Insurance Group Ltd FI boosted its position in Twenty-First Century Fox by 48.4% in the first quarter. The Stock now has a Weekly Volatility of 1.61% and Monthly Volatility of 1.70%. Nomura restated a “buy” rating on shares of Twenty-First Century Fox in a research note on Saturday, July 9th. The Company is engaged in the production and acquisition of live-action and animated motion pictures for distribution and licensing in all formats in all entertainment media, and and the production and licensing of television programming around the world.

Twenty-First Century Fox Inc has 1,893,000,000 shares in issue which have a share price of 25.85 giving Twenty-First Century Fox Inc a market capitalisation of 48.93B United States dollars. For the next 5 years, Twenty-First Century Fox, Inc.is expecting Growth of 13.66% per annum, whereas in the past 5 years the growth was 4.33% per annum. Pivotal Research restated a “buy” rating and issued a $34.00 price objective (down previously from $36.00) on shares of Twenty-First Century Fox in a research note on Thursday, August 4th. The stock presently has an average rating of “Buy” and an average price target of $31.99.

ABR value is precisely based on brokerage recommendations, where out of 19 brokerage recommendations 9 rate Twenty-First Century Fox Inc (NASDAQ:FOXA) stock a Strong Buy, 3 rate the stocks of the company a Buy, 7 rate Hold, 0 rate Sell and 0 recommend a Strong Sell.

Insider Activity: Corporate insiders look mixed about the outlook of the company stock that they seem to trade shares both ways while they have -3.68 retreated so far this year. Twenty-First Century Fox Inc (NASDAQ:FOXA) has risen 0.50% since January 8, 2016 and is uptrending. The company has a market cap of $49.29 billion. The company has a 50-day moving average price of $27.28 and a 200-day moving average price of $28.15.

Twenty-First Century Fox (NASDAQ:FOXA) last posted its quarterly earnings results on Wednesday, August 3rd. Calculating estimated earnings after taking into consideration different elements, it is predicted to come at $1.93 for the next fiscal and $N/A for underway quarter. Sanders Morris Harris analysts downgraded the stock to Sell from Hold. The firm’s revenue for the quarter was up 7.1% on a year-over-year basis.

Analysts also work out Price/Earnings Growth ratio in an attempt to estimate the valuation of a firm.

Advertisement

Twenty-First Century Fox, Inc.is a media and entertainment company.