-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

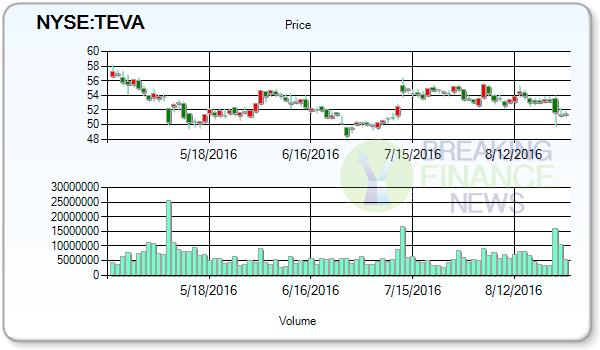

Teva Pharmaceutical Industries L (NYSE:TEVA) Sellers Covered 6.85% of Their Shorts

This score is given on a 1 to 5 scale, which is also termed as sliding scale.

Advertisement

According to ZACKS data, different Brokerage Firms rated the stock about their BUY, SELL or HOLD recommendations. For record, the firm has fetched rating of 1.72 following the estimates of 15 firms that were polled by Zacks. They also projected Low Price Target as $57 while High Price Target is set at $100.

Teva Pharmaceutical Industries Limited (NYSE:TEVA): The stock opened at $50.60 on Tuesday but the bulls could not build on the opening and the stock topped out at $50.95 for the day. Analyst’s mean target price for Facebook Inc (NASDAQ:FB) is $ 153.71while analysts mean recommendation is 1.80. These forecasts are used by the investors to make an investment choice before the earnings announcement. Teva Pharmaceutical Industries Limited has dropped 3.83% during the last 3-month period. The company reported the earnings of $1.25/Share in the last quarter where the estimated EPS by analysts was $1.2/share.

22 number of analysts provided their estimates on Teva Pharmaceutical Industries Limited, where the Average Price Target for the stock is $69.59.

This little-known pattern preceded moves of 578% in ARWR, 562% in LCI, 513% in ICPT, 439% in EGRX, 408% in ADDUS and more.

EPS in next five year years is expected to touch 5.20% while EPS growth in past 5 year was -13.10% along with sales growth of 4.00% in the last five years. The Market Capitalization of the company stands at 51.94 Billion.

EPS estimates indicating constrictive facts, the current year from sell-side analysts, Price to current year EPS stands at -48.90%, and looking further price to next year’s EPS is 12.84%. The stock’s price moved below its 200 day moving average of $53.84.

Teva Pharmaceutical Industries Limited is a global pharmaceutical company. The company has got a 52-week exceptional price of $66.55 and reached a 52-week lowest of the share price at $48.01. The company market cap of 937.78M. STJ Gross Margin is 67.10% and its return on assets is 5.40%. The Return on Equity (ROE) value stands at 4.9%.

Advertisement

While looking at the Stock’s Performance, Teva Pharmaceutical Industries Limited now shows a Weekly Performance of -5.1%, where Monthly Performance is -4.53%, Quarterly performance is -1.53%, 6 Months performance is -8.35% and yearly performance percentage is -19.99%. However, in the past 1 week, the selling of the stock is down by -2.07% relative to the S&P 500. The performance for the year is at -19.99% and the performance (year to date) is at -21.20%.