-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

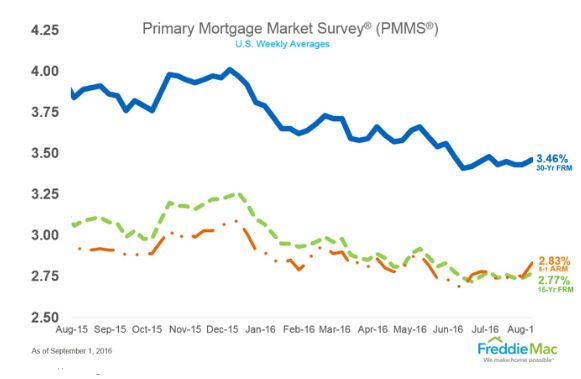

Gold Takes Strength from US Jobs Report

USA and European shares gained yesterday after weaker-than-expected United States monthly jobs data gave the Federal Reserve more leeway to stand pat on interest rates this month, while the dollar gained and longer-dated Treasury yields edged up.

Advertisement

Hawkish statements from Fed Chair Janet Yellen and Vice Chair Stanley Fischer last week had increased expectations that the U.S. central bank is closer to raising rates, though most investors see one increase in December as most likely if the Fed hikes this year.

US factory activity contracted in August for the first time in six months as new orders and production tumbled, but a low level of layoffs continued to point to a pickup in economic growth in the third quarter.

“The jobs data is not weak enough to get people to give up on their Fed view”, said Marc Chandler, global head of currency strategy at Brown Brothers Harriman in NY.

Traders of interest rate futures see about a one in four chance of a rate hike at the Fed’s September 20-21 meeting.

It increased further to 1.60 percent Thursday morning.

MSCI’s all-country world equity index was last up 2.94 points, or 0.7 per cent, at 420.29. The Nasdaq Composite closed up 22.69 points, or 0.43 percent, at 5,249.90.

The dollar index .DXY , which measures the greenback against a basket of six major currencies, rose 0.21 percent to 95.667, after earlier falling to 95.189, the lowest level since last Friday.

Spot gold jumped to a session high of $1,328.73 US after the non-farm payrolls data, and was up 0.5% at $1,319.64 U.S.an ounce.

Gold for December settlement on the Comex division of the New York Mercantile Exchange gained $8.30 or 0.6 percent to $1,325.40 per ounce.

But yields reversed that drop later in the session, with two-year yields last little changed at 0.794 percent and 10-year yields last at 1.601 percent, compared with a 10-year yield of 1.570 percent late on Thursday.

“It was obviously lower than expected, which goes counter to (the Fed raising rates) in September, but it doesn’t necessarily count them out for the year”, said Ellis Phifer, market strategist at Raymond James in Memphis.

The dollar’s initial weakness helped prompt gains in oil prices, though despite the day’s rise, crude prices still ended the week sharply lower on concerns about oversupply. U.S. crude settled up $1.28, or 2.97 per cent, at $44.44 a barrel.

Advertisement

USA treasury yields fell. US gold futures added 0.7% to $1,326.80 U.S.an ounce.