-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

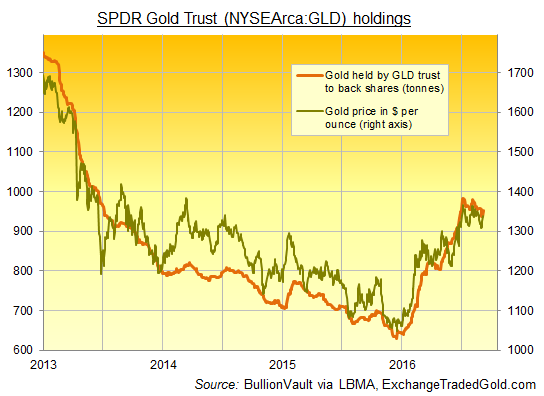

Gold poised for breakout on ‘lower-for-longer’ interest rates

“There are just not enough (assets) for the European Central Bank to buy”.

Advertisement

Draghi added that interest rates would remain at present or lower levels for an “extended time” so the recovery would not be derailed.

Investor demand for gold-tracking ETF the SPDR Gold Trust (NYSEArca:GLD) yesterday returned from the US Labor Day holiday to need an extra 14.2 tonnes, the heaviest 1-day inflow since immediately after the Independence Day holiday on 4th July.

Bond traders pared the chance of a September Federal Reserve interest-rate increase to an nearly three-week low as tepid economic data pushed Goldman Sachs Group Inc.to reduce the likelihood of a hike this month, reversing a revision made just five days ago.

In an email to clients this morning, Alec Phillips, U.S. Political Economist in Global Investment Research at Goldman Sachs, offered a review of monetary actions by the Federal Reserve ahead of important elections. Rising US interest rates increase the opportunity cost of holding nonyielding bullion and boost the dollar, in which gold is priced.

Shanghai’s benchmark gold price today fixed at ¥290 per gram, offering importers only a modest premium above wholesale London gold bar prices of $1.50 per ounce, down from the recent $2.50 average.

“In the absence of bullish factors, gold tends to recede rather than hold steady”.

“Any uncertainty, geopolitical tensions and, most importantly, a sense that the Fed will push back the next rate rise should put a near-term floor on gold prices. That said, gold looks to be on the defensive, at least near term”.

Spot gold may extend its gains to $1,358 per ounce, as it has cleared a resistance at $1,347, as per Reuters technical analyst Wang Tao.

The WSJ Dollar Index, which measures the dollar. When the United States dollar retreats, it encourages holders of worldwide currencies to buy dollar-denominated gold.

The yield on the Treasury two-year note, the coupon maturity most sensitive to Fed policy expectations, was little changed at 0.73 percent. Platinum rose 0.3% to $1088.20, after hitting a two-week high on Wednesday. Palladium was up 0.8 percent at $692.50.

Advertisement

The People’s Bank meantime grew China’s state gold reserves by less than 5 tonnes in August – markedly below both the last year’s average 13.7-tonne monthly addition and the previous 6 years’ average 8.4 tonnes per month – as gold bullion bar prices averaged new 3-year highs at $1341 per ounce.