-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

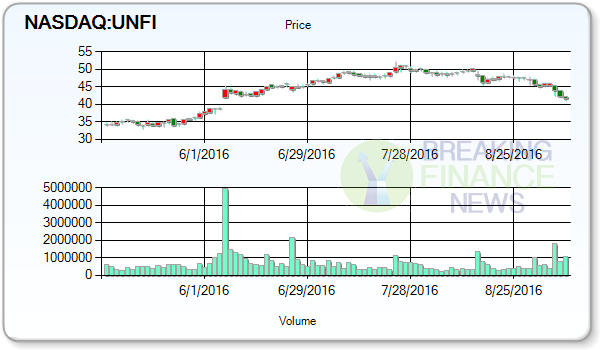

United Natural Foods Beats Q4 Expectations

Outlook: Fiscal 2017 GAAP EPS of $2.53-$2.63 on sales of $9.43 billion-$9.6 billion. Monsanto shares declined 1.18 percent to close at $106.78 on Friday. Vetr downgraded shares of United Natural Foods from a “strong-buy” rating to a “buy” rating and set a $37.14 price objective for the company.in a report on Monday, May 23rd. The stock has a 50-day moving average of $47.81 and a 200-day moving average of $41.73. The stock has a market cap of $2.11 billion, a price-to-earnings ratio of 16.53 and a beta of 1.03. Highbridge Capital Management LLC now owns 326,486 shares of the company’s stock valued at $12,850,000 after buying an additional 321,886 shares during the last quarter.

Advertisement

Why It Matters: United Natural Foods’ results will come as the grocery sector deals with an oversupply in some types of food – particularly meat, poultry and dairy – that have dragged prices lower and forced grocery stores into more aggressive promotions that some have compared to the industrywide price wars that took place in 2009. United Natural Foods had a net margin of 1.53% and a return on equity of 9.11%. The investment management company now holds a total of 202,171 shares of United Natural Foods which is valued at $10,041,834 after selling 15,612 shares in United Natural Foods, the firm said in a disclosure report filed with the SEC on Aug 15, 2016.United Natural Foods makes up approximately 0.28% of D.a. Davidson’s portfolio. Sales increased 7.4 percent year-over-year. Morgan Stanley reiterated a “sell” rating on shares of United Natural Foods in a report on Monday, June 6th. UNFI’s revenue was up 7.4% compared to the same quarter a year ago.

Advertisement

For the year, the company reported profit of $125.8 million, or $2.50 per share. Deutsche Bank AG reissued a hold rating on shares of United Natural Foods in a research report on Saturday, June 4th. Five analysts have rated the stock with a sell rating, thirteen have issued a hold rating and five have given a buy rating to the company’s stock. United Natural Foods makes up approx 0.06% of Two Sigma Advisers Lp’s portfolio.