-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

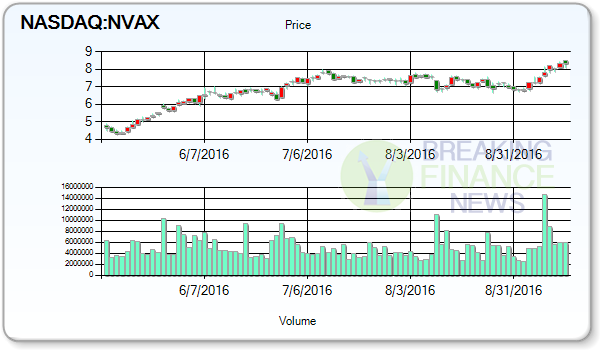

Novavax shares plummet more than 80% after vaccine trial fails

Rating Scale; where 1.0 rating means Strong Buy, 2.0 rating signify Buy, 3.0 recommendation reveals Hold, 4.0 rating score shows Sell and 5.0 displays Strong Sell signal. Piper Jaffray Cos. downgraded Novavax from an “overweight” rating to a “neutral” rating in a research note on Friday.

Advertisement

According to sentiments of 8 analysts the mean estimates of short term price target for the company’s stock is marked at $14.11. The current rating of the shares is Buy. The stock’s price fluctuated within the range of $8.10 – $8.42 during previous trading session.

TheStreet Ratings rated this stock as a “sell” with a ratings score of D.

Shares recently traded at $1.25, compared with their closing price of $8.34. The firm’s 50-day moving average price is $7.35 and its 200 day moving average price is $6.24. That puts the market capitalization at $2.25 bln. The stock stands almost -22.34% off versus the 52-week high and 103.68% away from the 52-week low. (NASDAQ:NVAX), according to U.S. Securities and Exchange Commission (SEC) filings. The biopharmaceutical company reported ($0.29) earnings per share for the quarter, missing analysts’ consensus estimates of ($0.25) by $0.04.

The company’s weaknesses can be seen in multiple areas, such as its feeble growth in its earnings per share, deteriorating net income, disappointing return on equity, weak operating cash flow and generally high debt management risk.

Along with these its year to date performance is standing at -0.95%. Novavax’s revenue for the quarter was down 82.1% on a year-over-year basis. A total of 5 equity analysts are now covering the company. Its SVP, CFO PHILLIPS BARCLAY A Purchased 422 company shares for $1000.81, in a transaction on 2016-07-31. State Street Corp boosted its stake in Novavax by 40.1% in the first quarter.

The company’s quick ratio for most recent quarter is 5.10 along with current ratio for most recent quarter of 5.10. Amalgamated Bank boosted its stake in Novavax by 1.1% in the second quarter. DIAM Co. Ltd. boosted its position in shares of Novavax by 2.6% in the second quarter. Institutional investors own 79.84% of the company’s stock.

Advertisement

Novavax, Inc. (NVAX) is a clinical-stage vaccine company committed to delivering novel products to prevent a broad range of infectious diseases. The Company through its recombinant nanoparticle vaccine technology produces vaccine candidates to respond to both known and newly emerging diseases. Novavax, Inc. (NASDAQ:NVAX) has a Return on Assets (ROA) of -56.30%.