-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

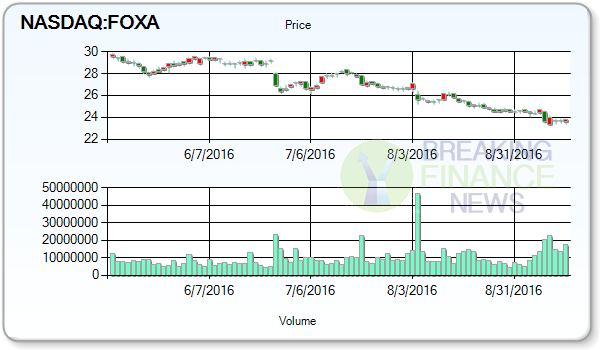

Investors Catching Stocks: Twenty-First Century Fox, Inc. (NASDAQ:FOXA)

Bernstein believes Twenty-First Century Fox faces many other risks such as lower domestic affiliate fees, reduced overseas advertising revenue and higher cable network expense, the Fly noted.

Advertisement

US based company, Twenty-First Century Fox, Inc.’s (FOXA)’s latest closing price distance was at -12.94% from the average-price of 200 days while it maintained a distance from the 50 Day Moving Average at -7.98% and -3.14% compared with the 20 Day Moving Average. 12 rated the company as a “Hold”. The Company expected to announce next earnings approximately $0.47 per share.

8/8/2016 – Twenty-First Century Fox was downgraded by analysts at Barclays PLC from an “overweight” rating to an “equal weight” rating. The stock’s current distance from 20-Day Simple Moving Average (SMA20) is -3.14% where SMA50 and SMA200 are -7.98% and -12.94% respectively. The co is presenting price to cash flow as 5.96 and while calculating price to free cash flow it concluded at 628.44, the low single digit may indicate stock is undervalued and vise versa. Mr. Shine runs all programming and news functions of each network, counting production, technical operations and talent administration. The Average sales target is based on the consensus of 27 brokerage Analysts. Now the company has earned “Buy” from 10 equity analysts. These analysts have also projected a Low Estimate of $0.34/share and a High Estimate of $0.56/share. FOXA’s value Change from Open was at -0.21% with a Gap of 0.17%. Riverhead Capital Management LLC now owns 1,954,562 shares of the company’s stock valued at $52,872,000 after buying an additional 1,791,477 shares during the period. They now have a United States dollars 31 price target on the stock.

8/4/2016 – Twenty-First Century Fox had its “buy” rating reaffirmed by analysts at RBC Capital Markets.

05/05/2016 – Twenty-First Century Fox, Inc. had its “outperform” rating reiterated by analysts at Telsey Advisory Group. Fiduciary Management Inc. WI purchased a new stake in shares of Twenty-First Century Fox during the first quarter valued at about $218,597,000. The two firm veterans were appointed co-presidents in August following Ailes resigned. The company reported $0.45 EPS for the quarter, topping analysts’ consensus estimates of $0.37 by $0.08. P/E (price to earnings) ratio is 16.68 and Forward P/E ratio of 10.89. The business earned $6.65 billion during the quarter, compared to analysts’ expectations of $6.68 billion.

The stock showed weekly upbeat performance of -2.04%, which maintained for the month at -7.61%. The company’s strengths can be seen in multiple areas, such as its increase in net income, revenue growth and growth in earnings per share.

Advertisement

This story is the sole property of American Banking News and it was originally published by American Banking News. $0.18 was paid by the company as dividend. Stockholders of record on Wednesday, September 14th will be issued a $0.18 dividend. Twenty-First Century Fox’s dividend payout ratio (DPR) is presently 25.35%. The ex-dividend date is Monday, September 12th. Ltd. boosted its position in shares of Twenty-First Century Fox by 121.5% in the second quarter. Twenty-First Century Fox, Inc. shows a total market cap of $ 19691.53, and a gross margin of *TBA while the profit margin showing *TBA. Fox produces and licenses news, sports, movie, and general and factual entertainment programming for distribution primarily through cable television systems, direct broadcast satellite operators, telecommunications companies, and online video distributors.