-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

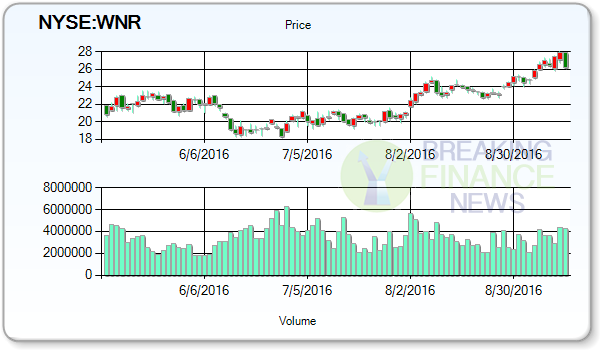

Western Refining Inc. (WNR) Upgraded to “Neutral” by JPMorgan Chase & Co

Analyst’s consensus target price is measured at $27.60 for twelve month. The company’s price sits 20.08% below from its 50-day moving average of $24.23and 3.47% far from the stock’s 200-day moving average which is $24.09.

Advertisement

Price Momentum: Despite the 4.61% rise in value, the stock’s new closing price reflects a -39.81% fall in price from company’s one year high of $47.55.

11/16/2015 – Western Refining Logistics, LP had its “hold” rating reiterated by analysts at Deutsche Bank.

Western Refining Logistics LP (NYSE:WNRL)’s stock had its “neutral” rating reissued by equities research analysts at JPMorgan Chase & Co.in a research report issued on Friday. Piper Jaffray raises the price target from $16 per share to $19 per share on Western Refining.

Shares of Western Refining Inc.

Energy stocks were ending mostly lower, with the NYSE Energy Sector Index sinking 1.0% while shares of energy companies in the S&P 500 were down about 0.6% as a group. The stock showed weekly upbeat performance of 1.48%, which maintained for the month at 14.72%. The stock was purchased at an average price of $23.59 per share, with a total value of $7,666,750.00.

United States of America based company, Western Refining, Inc.’s (WNR)’s latest closing price distance was 3.47% from the average-price of 200 days while it maintained a distance from the 50 Day Moving Average at 20.08% and 10.03% compared with the 20 Day Moving Average. The stock has a market cap of $2.97 billion, a price-to-earnings ratio of 9.74 and a beta of 1.85. 2 announced “Sell Rating” and 0 disclosed “Underweight Rating”. The company reported $0.72 earnings per share for the quarter, beating analysts’ consensus estimates of $0.51 by $0.21.

In Western Refining, Inc.

These analysts also forecasted Growth Estimates for the Current Quarter for WNR to be -75.1%. Morgan Stanley set a $21.00 price objective on shares of Western Refining and gave the company a hold rating in a report on Wednesday, August 3rd. Also, Director Michael C. Linn acquired 11,200 shares of the stock in a transaction that occurred on Thursday, September 8th. If the company has a rating of 5, this would translate to a Strong Sell recommendation. Hedge funds and other institutional investors own 65.13% of the company’s stock. The company is covered by 4 Wall Street Brokerage Firms.

El Paso, TX-headquartered Western Refining is an independent refiner and marketer of refined petroleum products in the Southwestern and Mid-Atlantic regions of the U.S. Finally, Guggenheim Capital LLC increased its position in Western Refining Logistics by 311.1% in the second quarter.

Advertisement

Western Refining Logistics, LP owns, operates, develops, and acquires logistics and related assets and businesses to include terminals, storage tanks, pipelines and other logistics assets related to the terminaling, transportation, storage and distribution of crude oil and refined products.