-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

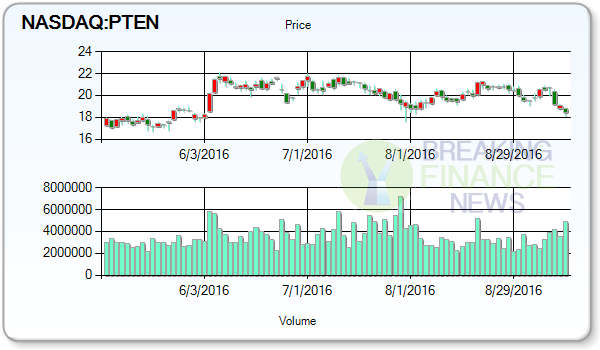

Patterson-UTI Energy To Acquire Drilling Technology Company

Separately, TheStreet Ratings Team has a “Sell” rating with a score of D+ on the stock. The Median price target for the stock is measured at $22.00. For the current quarter the stock has a lowest EPS estimates of $-0.61 and high estimate of $-0.57.For the current year Patterson-UTI Energy, Inc. The stocks close on the previous trading day was $18.42.

Advertisement

The company’s concentrated footprint in Marcellus Formation, Permian Basin and Eagleford Shale should provide economies of scale and also enhance its reputation for regional knowledge and efficient operations.

Analysts are expecting that the company to achieve $21.52 Price Target in next 52-weeks, average price is come up through the consensus of analysts.

Onshore contract driller, Patterson-UTI Energy Inc.

Patterson-UTI Energy Inc (NASDAQ:PTEN) has a 50 day moving average of 19.92 and a 200 day moving average of 19.08. Patterson-UTI Energy Inc.’s (PTEN) is a part of Basic Materials sector and belongs to Oil & Gas Drilling & Exploration industry. The firm’s market cap is $2.69 billion.

Alon USA Energy, Inc. Patterson now carries a Zacks Rank #3 (Hold), which implies that the company will perform in line with the broader USA equity market over the next one to three months. Analysts covering the shares maintain a consensus Buy rating, according to Zacks Investment Research. Patterson-UTI Energy, Inc. (NASDAQ:PTEN) shares were trading -16.64% below from the 52-week high price mark of $22.10 and 69.63% above from the 52-week price bottom of $10.86. This represents a $0.08 annualized dividend and a dividend yield of 0.42%.

Institutional sponsorship simply refers to ownership of a stock by mutual funds, banks, pension funds and other large institutions. State Street Corp raised its position in Patterson-UTI Energy by 2.7% in the first quarter. During its last trading session, Stock traded with the total exchanged volume of 3.24 million shares. Royce & Associates LP now owns 55,000 shares of the company’s stock worth $969,000 after buying an additional 5,000 shares during the period. However the company’s price to cash per share for most recent quarter stands at 13.99.

06/01/2016 – Patterson-UTI Energy, Inc. was downgraded to “underperform” by analysts at Credit Suisse.

05/02/2016 – Patterson-UTI Energy, Inc. was downgraded to “hold” by analysts at GMP Securities. The number of shares now owned by investors are 73.82 mln.

Patterson-UTI operates land-based drilling rigs in the USA and western Canada.

Advertisement

“We believe the combination of Patterson’s high-quality land drilling fleet and modern pressure pumping equipment, provides a one-two punch to weather the downturn and accelerate earnings growth through the recovery”, the firm wrote in an analyst note earlier today. The Company provides contract drilling services to oil and natural gas operators in the continental United States, and western and northern Canada.