-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Bank of England lifts United Kingdom third quarter growth forecast

The BOE’s commentary was published alongside the latest policy decision on Thursday, which showed all members voted to keep the key interest rate at a record-low 0.25 percent.

Advertisement

Investec experts are pencilling in a rate cut to 0.1% in November, when the Bank will have the next quarterly set of forecasts to hand in its inflation report.

Since then, there’s been a raft of data pointing to the British economy holding up better than anticipated by many in the wake of the Brexit vote.

The MPC is likely to reiterate that the Brexit uncertainty will drag on the economy as Britain and the European Union thrash out a new relationship over the next couple of years, probably resulting in less access for British exporters to the EU’s single market. This includes the preparation of derivative works of, or the incorporation of such content into other works.

The central bank could slash its rate to close to, but just above zero.

Economists had not expected a move at this meeting but said the Bank would be closely watching how the referendum outcome affected sentiment and activity in the months ahead.

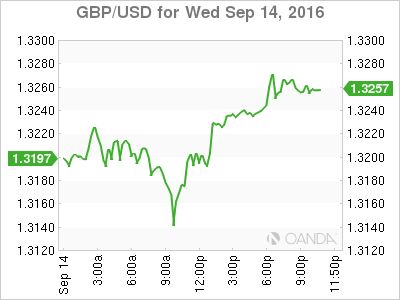

Earlier in the day, data showed United Kingdom retail sales retail sales fell at a much slower pace than expected in August, which had sent sterling to $1.3243 before the publication of the Bank of England’s latest minutes.

Jobs are a key indicator and the data suggest the pound’s 11 percent drop against the greenback since the June 23 vote to leave the European Union is helping United Kingdom companies stay competitive.

However, it is unlikely to boost further economic growth. Moreover, there had been no new information since the August Inflation Report relevant for longer-term prospects for the United Kingdom economy, the BoE added.

That could mean less borrowing, fewer tax cuts and a more robust statement on when he expects to bring the public finances into surplus. “Specifically, they expect business spending to slow more sharply than consumer spending in response to this uncertainty”.

“It would be wrong to be considerably more optimistic in view of the good economic data following the Brexit referendum”, said Esther Reichelt, currency strategist at Commerzbank.

It anticipates CPI inflation to rise to around its 2% target in the first half of 2017, consistent with the August Inflation Report, “albeit with the projection a little lower over the remainder of 2016 than had been anticipated in August”.

It pointed to the outlook for the housing market being “less negative than expected” and consumer demand being stronger than expected.

The report also suggests that the Fed will leave interest rates unchanged at its policy meeting next Tuesday and Wednesday.

Advertisement

The BoE also clearly indicated that it could cut rates again, possible as soon as November, unless the economy bounces back.