-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

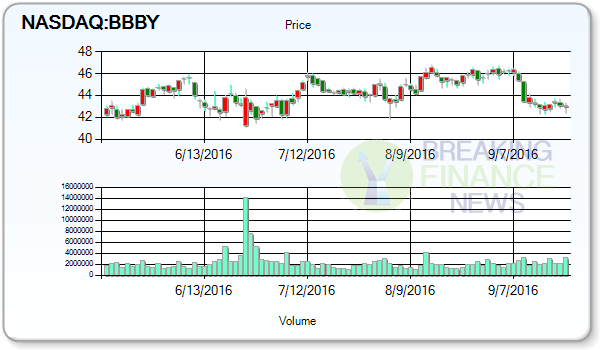

Bed Bath quarterly earnings slip

Shares of BBBY trade at the low end of their 52-week range of $41.15 to $61.90, swapping hands at $42.52 at last check.

Advertisement

Bed Bath & Beyond also announced a quarterly dividend of 12.5 cents a share, to be paid January 17. This represents a $0.50 dividend on an annualized basis and a dividend yield of 1.16%.

What happened with Bed Bath & Beyond this quarter? Wedbush reaffirmed a “neutral” rating and issued a $46.00 target price on shares of Bed Bath & Beyond in a research report on Wednesday, June 15th. BTIG Research assumed coverage on shares of Bed Bath & Beyond in a research note on Wednesday, June 1st. The average stock price target is $47.74 with 2 brokers rating the stock a strong buy, zero analysts rating the company a buy, nineteen analysts rating the company a hold, four analysts rating the company a underperform, and lastly 2 brokerages rating the stock a sell. The stock presently has an average rating of “Hold” and an average target price of $50.08. The Company sells a range of domestics merchandise and home furnishings. According to the latest information available, the market cap of the company is $6,650 M.

Bed Bath & Beyond (NASDAQ:BBBY) announced the earnings results for Fiscal Year 2016 and Q2. BBBY reported $1.11 earnings per share for the quarter, missing the analyst consensus estimate by $-0.05. Sales reached $2.98 billion, off slightly from $2.99 billion a year ago.

Given how much the stock has declined, it’s clear this buyback didn’t do Bed Bath any good. Bed Bath & Beyond’s revenue was down.2% on a year-over-year basis.

Bed Bath & Beyond’s gross margin continued to face pressure in Q2 2016. The shares were sold at an average price of $45.86, for a total value of $819,334.76. Following the sale, the chief operating officer now directly owns 140,630 shares of the company’s stock, valued at $6,449,291.80. JBLU institutional ownership remained 82.00% while insider ownership included 0.40%.

A number of large investors have recently added to or reduced their stakes in the stock. Cognios Capital LLC increased its position in Bed Bath & Beyond by 0.3% in the second quarter. Since 2012, the company has bought back $6.2 billion worth of stock. BlackRock Group LTD boosted its position in shares of Bed Bath & Beyond by 2.2% in the first quarter. Analysts had a consensus of $1.16. Nomura Holdings Inc. increased its position in Bed Bath & Beyond by 343.5% in the second quarter. BlackRock Group LTD now owns 1,690,744 shares of the retailer’s stock valued at $83,928,000 after buying an additional 35,621 shares during the last quarter.

Advertisement

Over the past year, shares have dropped close to 28% and earnings during the first quarter revealed a drop in sales at same stores and little revenue growth.