-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

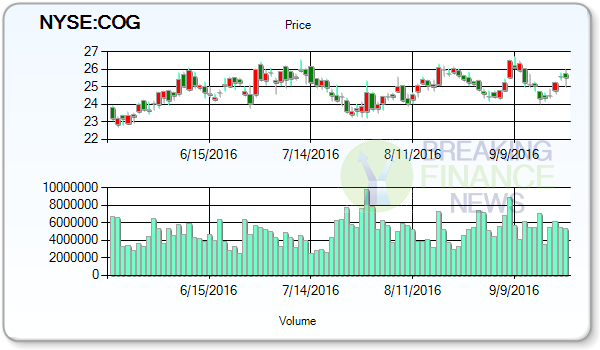

Cabot Oil & Gas Corporation (NYSE:COG) Stock Rises, Analysts: Hold Rating

One equities research analyst has rated the stock with a sell recommendation, eleven have issued a hold recommendation, twelve have given a buy recommendation and one has issued a strong buy recommendation on the company. In the last month the stock has moved in price -1.94%, with a one year change of 5.9%.

Advertisement

Cabot Oil & Gas Corporation (NYSE:COG) opened its last trading session at $24.5 and closed at $24.35 representing a Upside of 0.7 Percent.

The analyst consensus price target for Cabot Oil & Gas Corporation (NYSE:COG) is at $29.647. Finally, Zacks Investment Research cut shares of Cabot Oil & Gas Corp. from a “buy” rating to a “hold” rating in a report on Friday, August 5th. Finally, Jefferies Group restated a “buy” rating and set a $60.00 target price on shares of Cabot Corp.in a research report on Tuesday, September 13th. (NYSE:CBT) traded up 1.61% during midday trading on Wednesday, hitting $52.29. Cabot Oil & Gas Corp. has a 12-month low of $14.88 and a 12-month high of $26.74. Sterling Capital Management LLC now owns 51,855 shares of the company’s stock valued at $2,368,000 after buying an additional 440 shares during the period. The company has a 50 day moving average of $25.15 and a 200-day moving average of $24.19.

Cabot Corp. had a net margin of 5.68% and a return on equity of 13.91%. (NYSE:COG) last announced its quarterly earnings results on Friday, July 29th. Following the EPS trend, pool of analysts gave current quarter Per-Share Earnings estimates trends of $-0.01 for the COG while maintaining high price target of 38.00 and average of 28.93, as reported by WSJ. The company had revenue of $246.80 million for the quarter, compared to analysts’ expectations of $270.13 million. The firm has an EPS value of -0.56, resultantly displaying an EPS growth for this year at -210.00%. Cabot Oil & Gas Corp.’s revenue was down 19.4% compared to the same quarter previous year. Analysts, on average, forecast Cabot Oil & Gas Corporation to earn $0.06 per share (EPS) on revenue of $325.14M.

In a different news, on Sep 14, 2016, George Kevin Cunningham (Vice Pres. & General Counsel) sold 3,000 shares at $25.25 per share price. Currently, the stock carries a price to earnings ratio of 0, a price to book ratio of 0.73, and a price to sales ratio of 2.83. Following the transaction, the insider now directly owns 54,274 shares of the company’s stock, valued at $2,744,093.44.

Advertisement

A number of hedge funds and other institutional investors have recently modified their holdings of the company. Prudential Financial Inc. boosted its position in Cabot Oil & Gas Corp.by 6.5% in the first quarter. During its last trading session, Stock traded with the total exchanged volume of 5.48 million shares. Mason Street Advisors LLC acquired a new position in Cabot Corp. during the second quarter valued at approximately $1,299,000. Citigroup Inc. now owns 2,707 shares of the company’s stock valued at $123,000 after buying an additional 852 shares during the last quarter. The stock’s market capitalization is 3.15B, it has a 52-week low of 30.70 and a 52-week high of 52.53.