-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

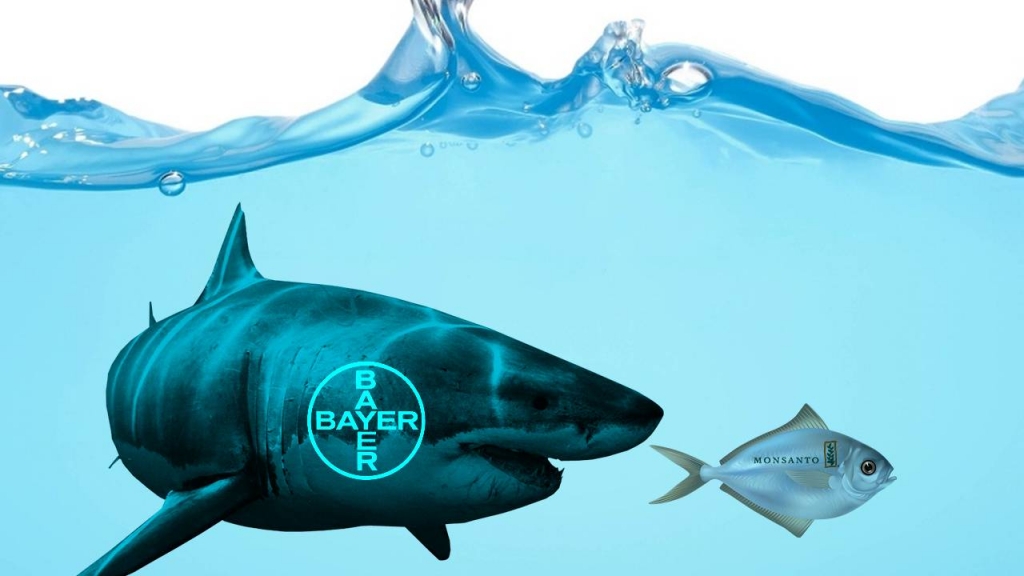

Monsanto (MON) CEO Grant, Bayer CEO Baumann Discuss $66 Billion Deal

Monsanto, known for its controversial genetically-modified products, will keep its seed business – and the USA headquarters of the merged group – at its home city of St Louis.

Advertisement

The deal is among the largest German corporate takeovers of a USA company, and would make Bayer the world’s largest supplier of seeds and farm chemicals, according to a recent note by Argus Research. Nevertheless, following this tie up of Bayer with Monsanto that will create a new leader with combined revenue of $26 billion from agriculture, the number of players will drop to only four. Despite the boards of both companies agreeing upon the deal, Monsanto shares closed a meager 0.57% higher.

Both Bayer and Monsanto have presence in India with the U.S. firm selling genetically modified (GM) cotton seeds in the country for more than a decade.

Elsewhere in the industry, US chemicals giants Dow Chemical and DuPont plan to merge and later spin off their respective seeds and crop chemicals operations into a major agribusiness.

Bayer’s offer is $4 billion more than the previous and a 44% premium over Monsanto’s stock price on May 9.

Bayer will pay Monsanto shareholders $128 a share in cash, the largest cash bid on record. Bayer expects the transaction to provide its shareholders with accretion to core EPS (earnings per share) in the first full year after closing and a double-digit percentage accretion in the third full year. The companies said their combined seeds and traits business will be in St. Louis along with its North American commercial headquarters.

“Today’s announcement is a testament to everything we’ve achieved and the value that we have created for our stakeholders at Monsanto”.

Founded in 1901, Monsanto in the past also produced pharmaceuticals and industrial chemicals, including toxic substances such as polychlorinated biphenyls, now banned and commonly known as PCBs, and the herbicide Agent Orange, which was used by the US military in Vietnam.

Advertisement

“We are entering a new era in agriculture – one with significant challenges that demand new, sustainable solutions and technologies to enable growers to produce more with less”, says Hugh Grant, chairman and CEO of Monsanto. This merger, the two groups hope to complete by the end of 2017, should also inflate their gross operating profit of about $ 1.5 billion after three years.