-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Interest rates – what today’s no-change decision means for your investments

Overnight interest swaps now price in a chance of just over 10 percent that the BoE will not raise interest rates at all this year – with a rate hike delayed until early 2019 – compared with a near-certainty of a 2018 rate rise earlier.

Advertisement

Ian McCafferty and Michael Saunders, the two most hawkish members of the MPC, voted to increase the rate to 0.75%.

The BoE trimmed its inflation forecasts and cut its growth outlook, but Governor Mark Carney said he expected the economy to recover speed, despite signs of more cautious consumers. But very weak UK GDP growth figures and fast-retreating inflation has seen a rapid reversal of the Old Lady’s increasingly unhelpful forward guidance.

He argued that the “underlying pace of growth remains more resilient than the headline data suggest”, though the bank still had to revise down its forecast for this year’s growth to 1.4 percent from 1.8 percent.

However, Carney also noted that the “economic outlook for the United Kingdom remains clouded by Brexit uncertainty”, despite an agreement on a transition deal between the country and the European Union being welcome. The current economic picture is somewhat gloomier than predicted back in November.

For them, inflation – which fell to a lower-than-expected 2.5% in March – was easing back as the impact of the Brexit-hit pound begins to fall away and would start to see upward pressure as wages pick up and other costs rise. For now, though, it’s carpe diem for mortgage-seeking landlords, particularly those who prefer variable rates.

The Pound Canadian Dollar (GBP/CAD) exchange rate continued to trend lower on Thursday as the Canadian Dollar (CAD) continued to be buoyed by rising oil prices, with Brent crude striking $77.50 a barrel as markets brace for potential disruption to Iran’s crude exports. If this rebounds as they expect then it is likely we could see a rate rise at any one of the upcoming meetings including June.

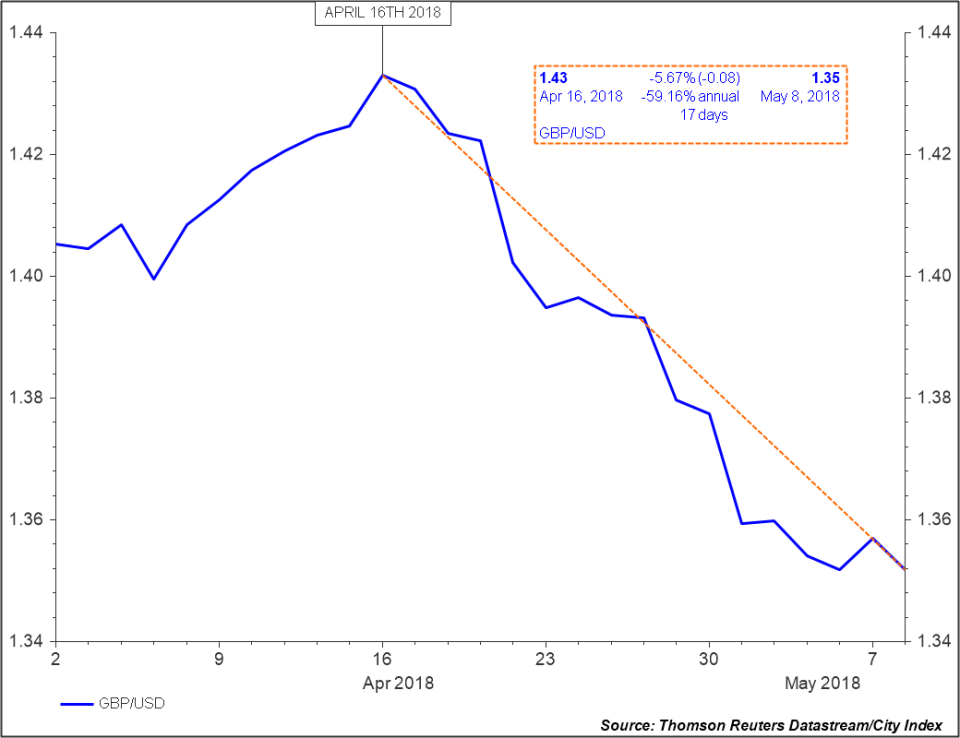

Sterling fell on the news and was trading lower by 0.2% against the United States dollar at 1.352.

And the Bank signalled that there would be three further rate increases in the coming years, signalling that even if rates rose that much, as markets expect, inflation would be on target at 2% in two years’ time.

However, borrowers were warned to prepare for higher rates as the Bank dismissed recent economic weakness as a weather-related blip. But it puts all this down to the first-quarter slump, which it suspects will be revised up to 0.3 percent from the initial estimate of 0.1 percent. Thursday’s forecast shows inflation should drop to 2.4 percent by year-end, instead of the previously forecast 2.7 percent.

Advertisement

The second reason the central bank opted against another rate increase is that inflation has fallen more than anticipated.