-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

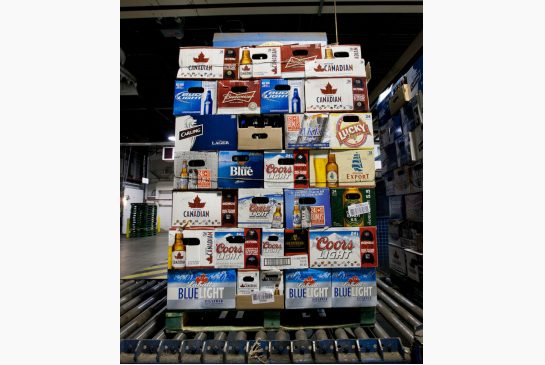

Altria supports Anheuser-Busch InBev’s proposed merger with SABMiller

Anheuser-Busch InBev NV on Wednesday said it had formally agreed to buy SABMiller PLC for £69,8 billion ($105,5 billion), a deal that creates a brewing behemoth that will dominate much of the global beer market.

Advertisement

The deal is being backed by a record US$75 billion syndicated loan, which is the largest commercial loan in the history of the global loan markets.

AB InBev’s tieup with Britain-based SABMiller, which the companies had agreed to in principle in October after months of wrangling, will give AB InBev a bigger presence in the Latin American and African markets.

“By pooling our resources we would build one of the world’s leading consumer-products companies”, said AB InBev Chief Executive Carlos Brito.

Beginning in the late ’80s, when Stella Artois maker Artois brewery and fellow Belgian-beer maker Piedboeuf merged to form Interbrew, which, when it merged with Brazilian company AmBev in 2004, became the “InBev” part of AB InBev.

The combined company expects to have a primary listing of its shares in Belgium, where Anheuser-Busch InBev is based, and secondary listings in Mexico, South Africa and the United States.

Furthermore, according to CNBC, these two beer giants own over hundreds of brands, including America’s most popular beer, Budweiser. “However, AB InBev’s offer represents an attractive premium and cash return for our shareholders, and secures earlier delivery of our long-term value potential, which is why the Board of SABMiller has unanimously recommended AB InBev’s offer”, SABMiller Chairman Jan du Plessis says.

Now what: The merger still needs full approval from regulators, but it took a big step towards that goal this week as Molson Coors appears to set to buy out the remaining stake in MillerCoors, a joint venture between MolsonCoors and SAB Miller.

The combined company would also have to address regulatory concerns in China where SABMiller has a 49 percent stake in Chinese beer Snow.

Under the terms of the AB InBev-SAB agreement, SABMiller shareholders would receive GBP 44.00 (British pounds, now about $67.50) per share in cash, with a partial share alternative available for up to 41 percent of the SABMiller shares.

Advertisement

But the USA market may be the least of AB InBev’s concerns. Bud, Miller will be separate in U.S. MillerCoors a year ago generated $7.85 billion in sales, nearly double Molson Coors’s net sales of $4.15 billion.