-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Bank of England holds interest rate against expectations

British government bond yields rose to a 10-day high on Thursday after the Bank of the England wrong-footed investors by keeping interest rates on hold, in its first monetary policy decision since last month’s Brexit vote.

Advertisement

The market has been recovering from a sharp, post-referendum sell-off partly on expectations of further stimulus from central banks; the FTSEurofirst index is down just 1.9 percent since the vote.

‘Lenders will continue to be open for business as usual, but lending volumes may be affected by uncertain consumer sentiment’.

‘Early indications from surveys and from contacts of the Bank’s agents suggest that some businesses are beginning to delay investment projects and postpone recruitment decisions’. Most had expected a 50 basis point cut to 0%, but the bank says it’s reviewing its options.

The Bank of England held its benchmark interest rate steady Thursday but officials said they expect to launch fresh stimulus on multiple fronts next month, as the economy stumbles under Britons’ decision to exit the European Union.

One MPC member, Gertjan Vlieghe, voted for an immediate cut to 0.25% amid signs that the European Union referendum decision was already hitting parts of the economy, with growth set to come under further pressure.

Sterling forward interest rates, which had been pricing in a strong chance of a cut in the bank’s 0.5 percent base rate to zero by September, now only fully price in a single quarter-point cut.

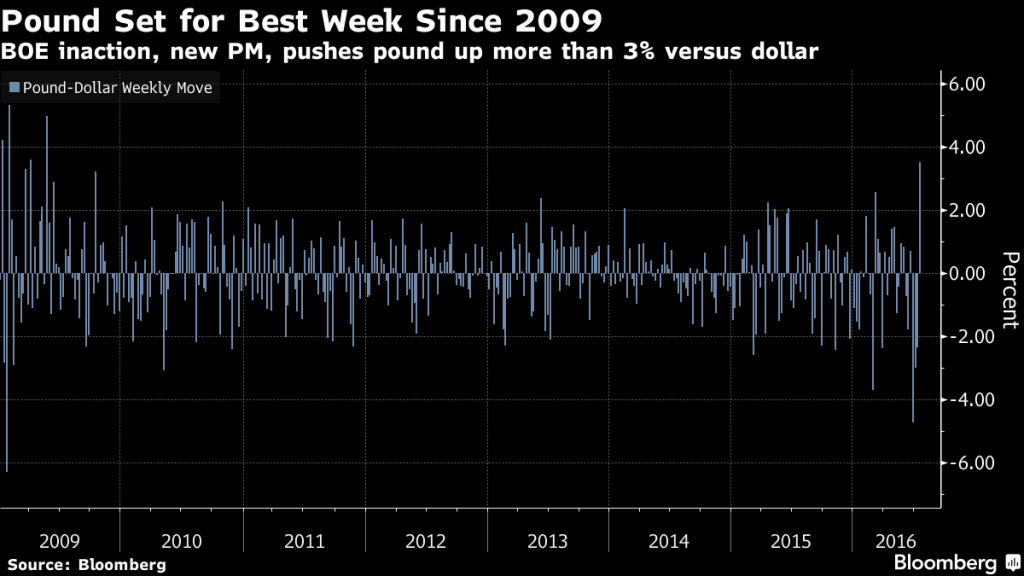

The U.K. now appears to be on a firmer political footing, with the new Prime Minister Theresa May taking office and appointing her cabinet today.

The decision to hold rates pushed sterling to a two-week high against the US dollar and government bond yields rose.

Mike Bell, global market strategist at JP Morgan Asset Management, says: “Since the vote, United Kingdom consumer confidence, hiring intentions, business expectations and the construction outlook have all fallen”.

Howard Archer, chief economist at IHS, said the Bank could use other methods such as quantitative easing – also known as “printing money” – as well as cutting rates. However, it did signal that it could cut rates at its meeting in early August after receiving additional data on how the economy is faring in the wake of the June 23 referendum.

Jeremy Stretch, an FX strategist at CIBC capital markets, has suggested there is pressure on the BOE to follow-through with Carney’s pledge to cut interest rates at his June 30 speech.

Advertisement

The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target and in a way that helps to sustain growth and employment. “The precise size and nature of any stimulatory measures will be determined during the August forecast and Inflation Report round”, said the minutes.