-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

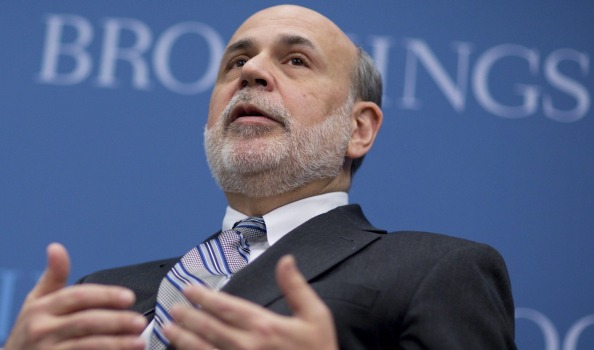

Ben Bernanke says Larger Number of Executives Involved in 2008 Financial

Despite a textbook interview, he did admit that the Fed does way too much now.

Advertisement

“[The Fed] has a 2 percent inflation target. We’re not there yet”. Bernanke was promoting his memoir The Courage to Act, which details the Fed’s response to the crisis.

The Fed in September chose to delay a rate hike because of concerns about developments in financial markets and China.

Do not raise interest rates so soon, says former Federal Reserve Chair Ben Bernanke.

It is informative to think about late USA financial execution with that of Europe, a noteworthy industrialized economy of comparable size.

In the long term, low or no inflation has risks, he warned.

I agree with him, but historic low rates are fueling inequality and the buyback binge, which is very deflationary. “What happens where there’s a recession, there’s no where to cut”. “That doesn’t make any sense”.

“Future negotiations could be jeopardized if the government refused to honor the agreement with Citi that it had helped to arrange”, Bernanke says in the book.

Ben Bernanke is rightly crowing about the route in which the Federal Reserve (drove, at the time, by one B. Bernanke, ahem) spared the United States economy.

The China slowdown has been “broadly anticipated”, he said, because of Beijing’s move to more of a consumer-driven economy.

In the grand Washington tradition of speaking truth to power after any good can come of it (Eisenhower warning us of the military-industrial complex on his way out of office comes to mind), Bernanke confirms what everybody already knew. The Chinese markets are closed for a national holiday.

Bernanke, who presided over the US central bank during the financial crisis considered the worst since the Great Depression, said it was not up to him to decide whether to prosecute individuals, noting: “The Fed is not a law-enforcement agency”.

A better headline would have been the Fed can’t act alone, he said.

“The Fed has been using easy money because the economy has needed a lot of support”, he argued. “The Fed has been the only game in town; it’s been doing most of the policy heavy lifting over the last few years”. But they might have been strengthened by a dose of the prescription he hinted at with USA Today: Punish the human beings who created the crisis. He’s also a senior advisor to hedge fund Citadel and bond powerhouse Pimco. “Now, a financial firm, of course, is a legal fiction”.

His worst moment in the Grand Daddy of all financial panics in 2008. “We felt we had to, given Lehman had failed”.

Advertisement

“When I called to tell her, she broke into tears, and they were not tears of joy”, he said.