-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

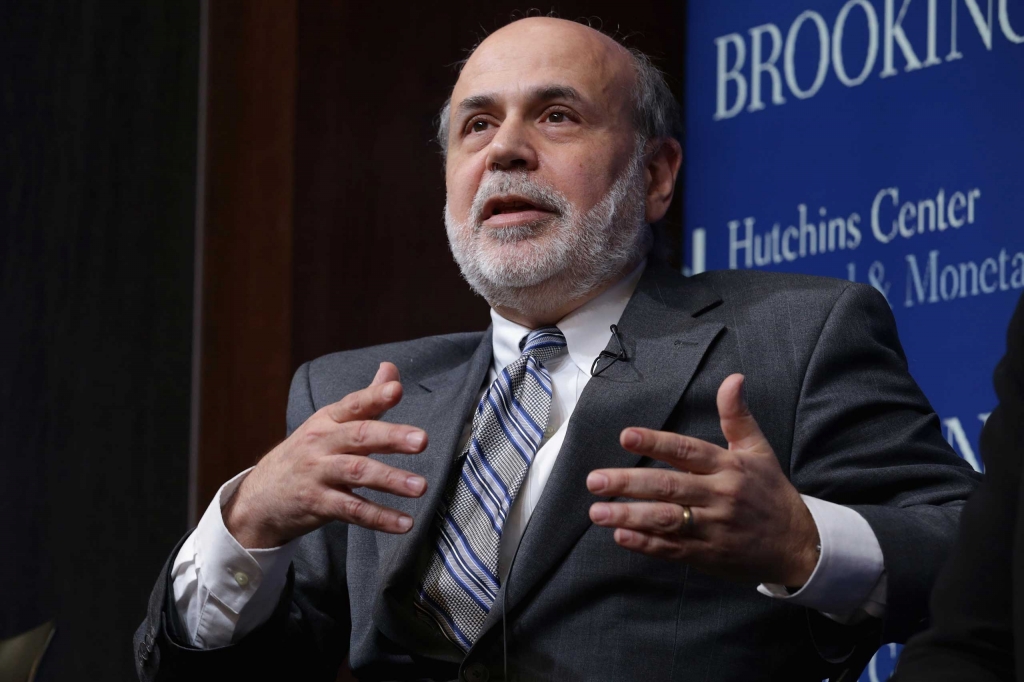

Bernanke: Wall St execs should have gone to jail for crisis

Europe’s failure to employ monetary and fiscal policy aggressively after the financial crisis is a big reason that eurozone output is today about 0.8% below its precrisis peak.

Advertisement

Bernanke credited those differences to aggressive efforts by the Fed to jump-start economic growth.

The former Fed chairman said the argument the USA central bank should raise rates so it would have room to later cut them “doesn’t make any sense”.

As for new regulations imposed on banks after the crisis, Bernanke defends the Obama administration’s decision not to push for a new Glass-Steagall type wall between investment banking and traditional banking.

“Future negotiations could be jeopardized if the government refused to honor the agreement with Citi that it had helped to arrange”, Bernanke says in the book. Due to the peer pressure, he had to leave Federal Services in the yer 2014.

Growth has been slower around the world, but the United States economy has been doing better than others, Bernanke said.

Former Fed Chairman Ben Bernanke said Monday that he was not sure the economy could handle four quarter-point rate hikes.

In the interview, Bernanke defended his decision, saying: “If we hadn’t prevented the collapse of Wall Street, then Main Street would’ve collapsed as well”. “The panic that hit us was enormous – I think the worst in USA history”.

No longer a policymaker, Bernanke is letting his hair down in his soon-to-be-released memoirs, “The Courage to Act: A Memoir of a Crisis and Its Aftermath”. “That is not obvious, I don’t think everybody would agree to that”, he added in an interview with CNBC.

“It’s been very interesting what the European central banks have been able to do in terms of actually provide more stimulus than I would have expected, by driving interest rates below what economists used to call the zero lower bound”, Kocherlakota said. Its committee, led by Bernanke’s hand-picked successor, Janet Yellen, could raise interest rates for the first time in nearly a decade.

Advertisement

“If there are bad actors, you should go after them” individually, he said. He says he and the Treasury secretaries he worked with, Henry Paulson followed by Timothy Geithner, all shared the view that the practical aspects of shoring up the economy were more important than the “political considerations” pointing toward punishment of individual wrongdoers. Still, unlike Greenspan who sent out a dire warning on bonds in August, Bernanke is very cautious as he sees many risks to this tepid recovery.