-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

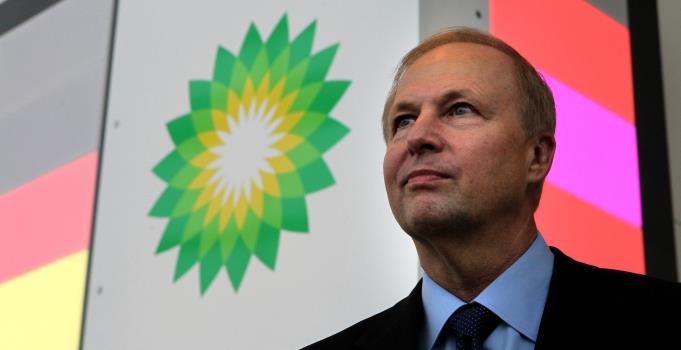

BP boss Bob Dudley faces shareholders amid anger over pay package

On the day when BP PLC’s (LON:BP.) is getting it in the neck at the company’s annual general meeting (AGM) for what many regard as exorbitant pay for presiding over a company that made a $5.2bn loss, the Wall Street Journal (WSJ) helpfully points out that most top oil executives are seeing their pay shrink.

Advertisement

Many shareholders have serious issues with Dudley’s rise as it comes after BP reported a £3.6bn loss and outlined plans to axe thousands of jobs.

Aberdeen Asset Management, an investor, called Dudley’s pay structure was “overly complex” and said it was confident “the company will take note of shareholders’ feedback”.

“We know already from the proxies received and conversations with our institutional investors that there is real concern over the directors’ pay in this challenging year for our shareholders”.

“Other executive pay packages shrank along with stock prices”.

A spokesman for BP said shareholders themselves had backed the formula.

The Institute of Directors said it feared an endorsement “could send the wrong message to other companies”. “While we acknowledge BP has had to weather a turbulent period for oil markets, we strongly believe that executive remuneration should remain tied to performance”.

The pay deal will see his salary rise from 1.82 million U.S. dollars (£1.27 million) in 2014 to 1.85 million USA dollars (£1.3 million) for 2015, while his annual cash bonus will also rise from 1 million United States dollars (£ 702,733 ) in 2014 to 1.39 million U.S. dollars (£ 976,799 ) for a year ago.

Shareholders are to discuss if the pay rise is deserving, considering the recent job cuts and falling profits at the company amid the oil crisis.

BP’s fourth-quarter earnings plunged 91 per cent after being hit by low oil prices.

The group’s remuneration policy is voted on every three years, with the next vote taking place at the AGM in 2017. “BP’s performance surpassed the board’s expectations on nearly all of the measures that determine remuneration – and the outcome, therefore, reflects this”, he said.

Advertisement

It is rare that the IoD intervenes on the subject of an individual chief executive’s pay.