-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Brent crude riding high as OPEC deal kicks in

Prices have been buoyed by hopes that a deal between OPEC and other big oil exporters to cut production will drain a global supply glut.

Advertisement

Investors were cheering the kick-off of a production cut deal struck by Opec and non-member oil-producing states including Russian Federation late a year ago.

US crude rose 2.1% to $54.85 per barrel after hitting an 18-month high of $55.24.

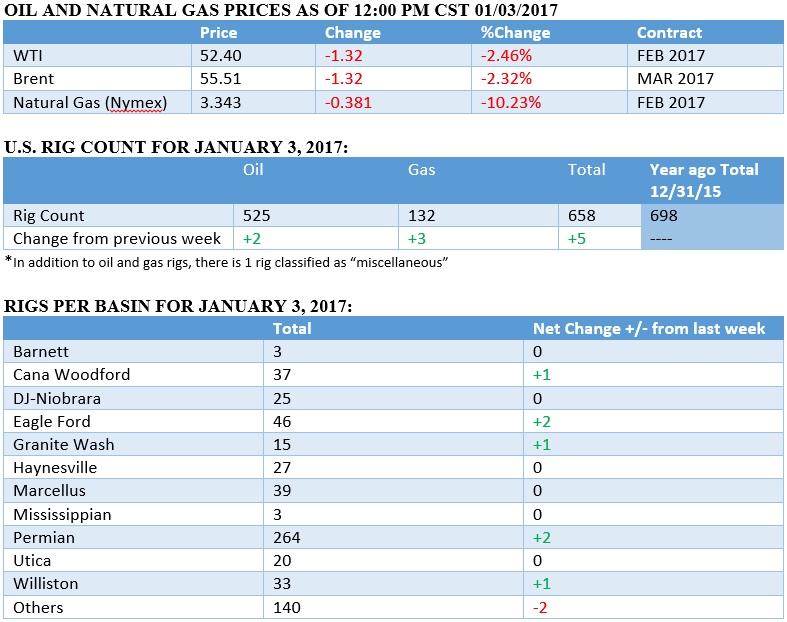

West Texas Intermediate for February delivery gained as much as $1.52 to $55.24/bbl on the New York Mercantile Exchange and was at $55.04 as of 11:35 a.m. London time. WTI Crude is up 1.88 percent at $54.73 (1557GMT). Already, U.S. shale producers have responded to last year’s price rebound by adding rigs, and any steep increase in prices is likely to spur more drilling.

A more expensive dollar reduces demand for greenback-denominated assets, such as crude oil.

In a detailed report, the Arab Investment & Export Credit Guarantee revealed that Arab economies have been witnessing, since the beginning of the third millennium, different consequences that varied from one country to another.

The U.S. dollar remained firm during Tuesday’s Asian session, with the dollar index trading at 12.600.DXY, 0.4 percent higher.

Crude oil prices increased as investors expect that the deal between OPEC and non-OPEC countries to reduce output will be able to end the global oversupply.

As we know all too well, all paths lead back to energy, hence as oil prices rise, preliminary German inflation data has reached its quickest pace since 2013.

Oil prices jumped on the first trading day of the year following supportive comments from Saudi Arabia, Kuwait and Oman, although the focus remains on whether major oil producers will deliver on pledges to curb output.

Advertisement

According to many economists and market watchers, January will play the role of an indicator of whether the agreement will be respected.