-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

China Shares Eke Out Some Gains

Hong Kong’s Hang Seng Index, which closed down 5.8 per cent yesterday, was up 0.9 per cent in early trading.

Advertisement

For all its power and history of applying command-and-control tactics, Beijing is learning that it isn’t so easy to tame market beasts.

Stability has always been the cornerstone of Chinese rule. “Market forces can be like a tsunami and you can be hit”. “The authorities made us believe that we can make money from a bull market but actually we are falling into an abyss losing most of our life savings”.

The state of the Chinese stock market… To get there, though, it had fallen more than eighty points in half an hour, following a jarring 200-point gain shortly after markets opened.

China remains a command economy, which gives it ballast against a Great Depression-like outcome.

For months, analysts have been warning that China’s markets were distorted. Prices of oil, copper and other commodities, which are hugely dependent on China, also slumped further. Yet as talk swirled that a crash could shake confidence in Beijing’s capitalist transformation and send tremors across the global economy, analysts suggested there was little cause for panic just yet.

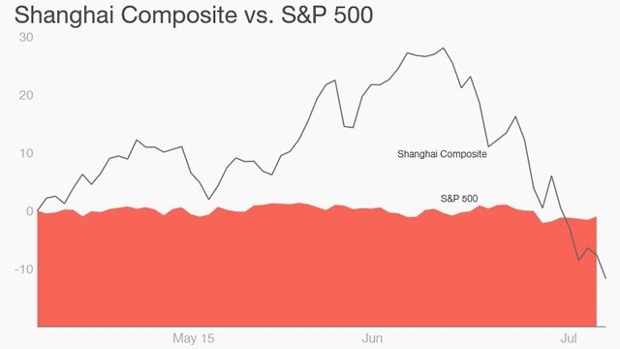

Treasury Secretary Jacob J. It seems that the Chinese stock market’s rebound, specifically the Shanghai shares, on Monday was nothing more than a short break.

“Institutional investors have been taking money off the table most of this year and part of last year”, said Cameron Brandt, director of research at EPFR Global, which tracks fund flows around the world. Less known is that Chinese companies have been doing the exact same thing by using their own corporate stock to secure loans from banks.

“The government will be able to stabilise the market because they have a lot of tools in the toolbox”, said Christopher Moltke-Leth, head of institutional client trading at Saxo Capital Markets.

But while this all sounds pretty much like doom, it’s worth noting the Shanghai Composite Index remains 72% above where it was 12 months ago. He has lost two-thirds of that.

Brokerages are also helping themselves by helping the market, said the employee. “The whole society was in a fervor”.

CNN explains that the initial bull market was partly a result of state media hype. But unlike then, many Chinese investors today bought shares with borrowed funds.

What goes up must come down, in physics and in the financial markets, and on Wednesday, that was the case in the financial markets in China.

Regulators also tightened lending to stock investors, adding to their fears.

The Chinese economy is not doing well, despite its government’s best efforts to boost growth through easing monetary policy.

A Chinese investor covers her eyes Wednesday at a brokerage house in Nantong, Jiangsu province, China.

Markets | USA stocks have tumbled in opening trade as another big drop in the Chinese equity markets amplifies concerns about the world’s second-biggest economy.

The government intervention comes with a price.

The market collapse in what were previously booming stock markets, which had more than doubled in the year to mid-June, presents a major headache for Chinese president Xi Jinping and other top leaders, who are already grappling with flagging economic growth.

Advertisement

The upshot is that as long as blue chips are not stabilised, Beijing will do more to support the Chinese equities.