-

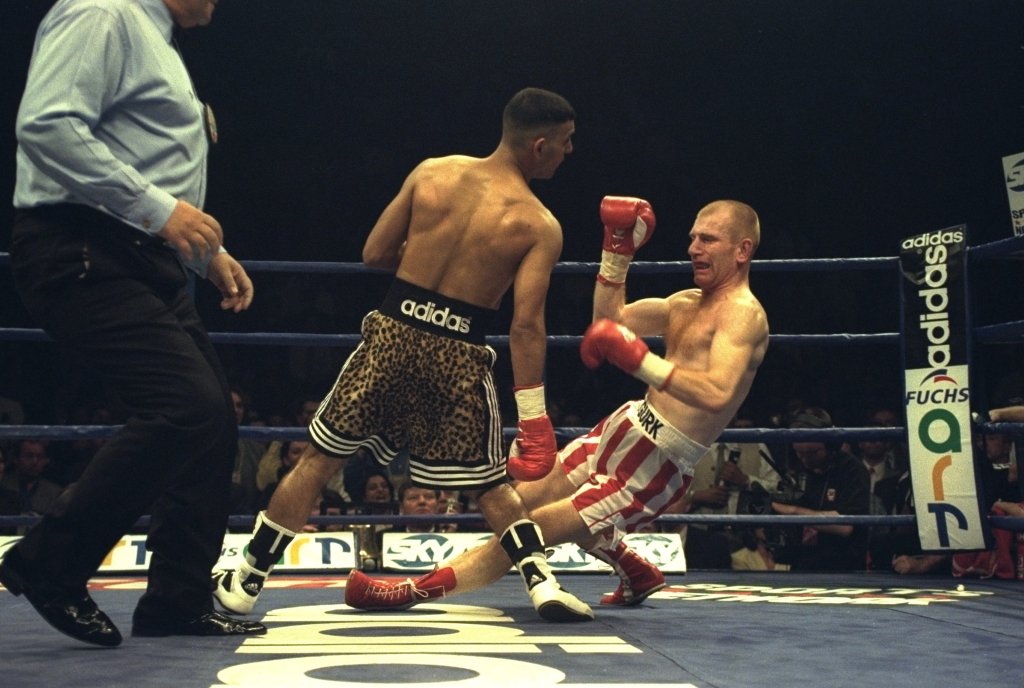

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Chronicle of Bust Foretold as Iron Ore Futures Slide Below $50

Iron ore and rebar (reinforced steel) both traded limit down (6 percent) in trading on China’s Dalian Commodity Exchange and the Shanghai Futures Exchange, respectively. That raises the question: Why are mills exporting more steel when Shanghai front-month futures prices for rebar steel rocketed 48% between January and April, and signaled a potential rise in demand?

Advertisement

“We continue to see good macro data in (China´s) property sector and infrastructure investment may come through a lot more strongly than people think”, said analyst Lachlan Shaw at UBS in Melbourne.

China’s Dalian soybeans slid for a fourth consecutive session on Monday to their lowest in almost three weeks even as strong demand from the world’s top importer of the commodity drove the benchmark USA prices higher. On the Dalian Commodity Exchange, the most-active iron ore was down 4.8 per cent at 384 yuan a tonne after hitting a session low of 379.50 yuan, its lowest since April 11.

While the bearish predictions throw bad news in the way of the steelmaking commodity, which just over two weeks ago hit a 16-month high, the prices are actually a hefty increase over Goldman Sachs’ earlier projections for iron ore. Stockpiles of iron ore at China’s ports expanded to nearly 100 million tons, and rebar inventories climbed for the first time in nine weeks.

Retail buyers poured into funds that rushed into China’s commodities futures last month, hoping a stabilising economy would boost demand for raw materials, lifting prices and volumes of everything from steel to cotton.

Steel reinforcement bar, used to strengthen concrete, has soared 31 per cent in 2016 after dropping for five years.

India’s steel consumption rose by 4.3 percent in the last fiscal to 80.27 MT compared to 2014-15.

Chinese customs data issued on Sunday showed that iron ore imports fell 2.2 percent from March to 83.92 million tonnes, while copper ore and concentrate imports shed 8 percent on the month to 1.26 million tonnes.

Advertisement

ArcelorMittal, the biggest steel-producing company in China, last week cautioned that while it saw a broad recovery in the global market, Chinese prices might have overshot and could fall back. The drop was attributed to deepening worries about China’s demand.