-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

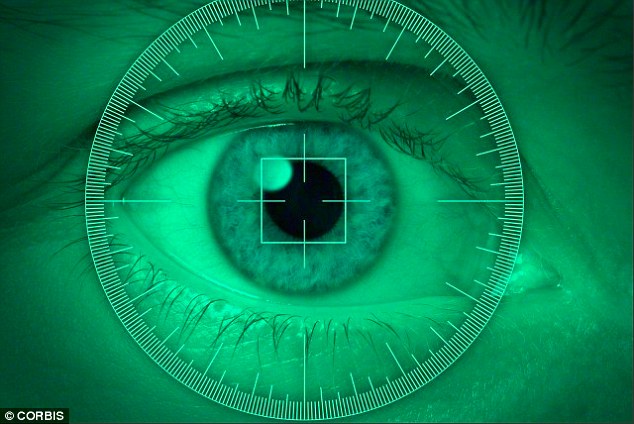

Citigroup Testing Card-less ATM with Eye-Scanning System

Like Irving it ditches card readers in favour of mobile phone-based access but does have a tablet touch screen for cheque imaging, ID scanning for new accounts and document signing, and video teller access. Diebold and Citigroup are partnering to test a new mobile-friendly machine which would permit the customers to go off the plastic cards.

Advertisement

Citigroup is not the only financial institution testing out cardless cash machines and in the US JP Morgan Chase and Bank of America are working on similar technology.

One bank is trying to eliminate the debit card by testing new ATM technology that would allow you to make withdraws using your Smartphone and your eyes.

The test cash machines do not even need a screen or a touchpad as all the information is loaded by the app ahead of time.

According to Diebold, the transaction process takes less than 10 seconds.

The machine will then scan their iris and if verified, will then produce the money they had preselected.

Citigroup has been analyzing the viability of this new self-service solution ever since August, at its innovation lab located in Queens, New York.

Diebold argues that not only is the system faster than traditional ATMs but also more secure because there is no card reader for skimmers to tamper with.

“Small notes are used frequently in our daily life, but we usually can only get them at the bank counter”.

Advertisement

It remains to be seen if Citigroup will indeed incorporate this state-of-the-art technology.