-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

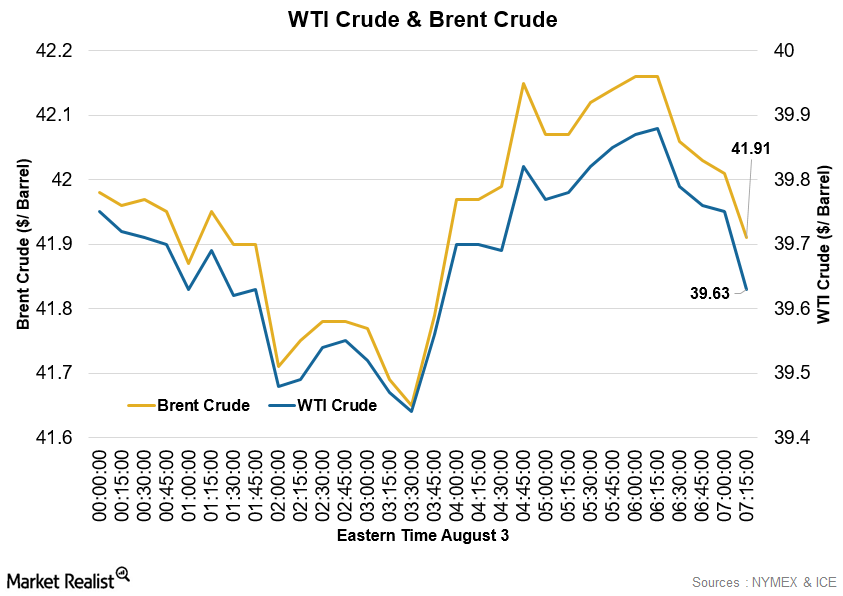

Crude Oil Prices Fall Below $40

“Japanese shares will be at higher risk for selling” if more investors “view rising oil inventories as a outcome of economic weakness”, said Seki Orimi, senior investment strategist at Mitsubishi UFJ Morgan Stanley Securities.

Advertisement

The commodity funds showed positive performance over the first six months of this year, with average returns of 19.95 percent after posting record-low results in 2015 due to free fall in oil prices.

Oil settled at the lowest level in nearly four months, following a drop in US stocks as global growth concerns resurface.

US West Texas Intermediate (WTI) crude futures were trading at $39.77 a barrel at 3.50am GMT, up 26c from their last settlement but still below the $40 marker they settled below for the first time since April in the previous session.

On the NYMEX, delivery of crude oil in September drop to a daily low of $40.57 a barrel, a level not met since April 20, before recovering to end at $41.60 by close of trade, increase 46 cents, or 1.12 percent.

Phil Flynn of Price Futures Group said it was in the nature of the bear market to be self-reinforcing. The global benchmark was at a premium of $1.47 to WTI for October. For more on crude oil prices, Read Part 1 and Part 2 in this series.

Gasoline inventories are expected to decline by 200,000 barrels while stocks of distillates, which include heating oil and diesel, are forecast to fall by 482,000 barrels, according to analysts. “We’re actually at record inventories for the two of those”.

While the oil industry isn’t happy about the recent slump in the price they get for their products, motorists are reaping the benefits.

In the week onward, oil traders will be concentrating on USA stock data on Tuesday and Wednesday for fresh supplies and demand indications.

There were further concerns that a modest rise in demand would not be sufficient to curb over-supply in the market, especially with USA and Asian refineries entering the maintenance season, which tends to curb demand.

Advertisement

Global supplies could swell as member nations in the Organization of Petroleum Exporting Countries work to restore halted output. Nigeria has resumed payments to former militants as the government seeks a cease-fire after attacks cut output to the lowest since 1989. Already high stockpiles of these refined products rose further when the demand for the product became significantly less than it should be to consume all the gasoline that had been refined to compensate for low prices.