-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

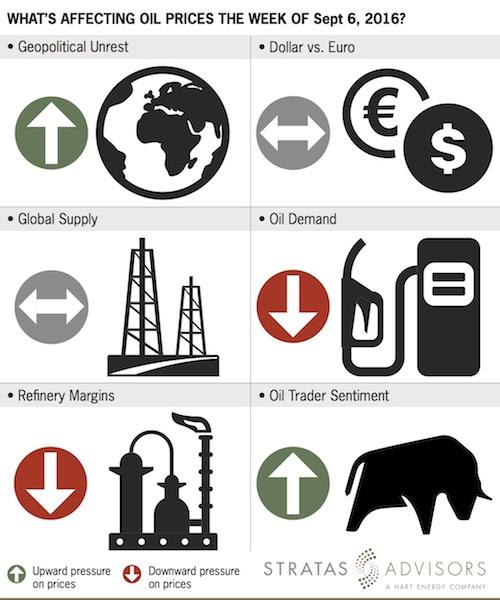

Crude oil rebounds from critical price level

With three weeks until their meeting in Algeria, oil traders are keeping tabs on Russian Federation and OPEC, hoping for signs they will find an agreement to address a global supply glut that has hammered prices for two years. November Brent crude on London’s ICE Futures exchange rose 72 cents, or 1.5%, to $47.98 a barrel.

Advertisement

NYMEX crude for October delivery was down 8 cents at $44.75, after settling up 39 cents on Tuesday.

Oil rose on Wednesday to pare some of the previous day’s losses, partly thanks to a weaker USA dollar, but the limited likelihood of a near-term agreement among the world’s biggest exporters to rein in production kept gains in check. Generally, I think we’ll see lower prices going forward.

If production is frozen at early-2015 levels, it would effectively mean an output cut as most producers – including Saudi Arabia, Russia, Iraq and Iran – have steeply boosted production since then. That price level was also concurrently at a descending trend line extending back to the June price highs, as well as at the 61.8% Fibonacci retracement of the last major rally in August. “If OPEC freezes at these levels, these are record levels”, said Tariq Zahir, analyst at Tyche Capital Advisors.

“Iran is still talking about pre-sanction numbers and even with the production freeze, you’re still at such a high level”, Zahir said. “Certainly, some production was shut in because of the hurricane”, said Dominick Chirichella, senior partner at Energy Management Institute in NY.

There was a further draw in gasoline stocks of 2.3mn barrels following the draw of 1.6mn seen last week. In its monthly energy outlook report, the government agency forecast an average price of $41.92 a barrel for WTI this year, up from a previous estimate of $41.16.

Around the middle of 2017, drawdowns in global oil inventories are likely to begin, which will contribute to higher oil prices in the second quarter of next year, he said.

Trade was choppy as some traders eyed US oil inventory data due late Wednesday and Thursday morning for clearer direction.

Nationwide crude inventories plunged by 12.1 million barrels in the week to Sept 2, according to data released late Wednesday from the American Petroleum Institute.

Advertisement

Oil prices LCOc1 soared nearly 5 percent ahead of a news conference by the two ministers, but pared gains to trade up 2 percent by 6.30 a.m. ET as the agreement yielded no immediate action.