-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Devon Energy Corp (DVN) Stock Advances on Lower-Than-Expected Loss

Devon said it expected to produce 253,000-268,000 bbl/d in 2016, 3% more than its prior estimate, without additional capital spending. Revenues slipped to $2.1 billion, down from nearly $3.3 billion in the year-ago quarter.

Advertisement

Hager said the company had recently changed its hedging strategy, hedging some output each quarter on a “consistent programmatic basis” as far forward as six quarters, rather than relying exclusively on “opportunistic” hedges as it has historically.

While revenues were down, Devon also lowered its expenses.

‘Looking ahead, our top priority is to maintain a strong balance sheet, ‘ said Hager. Revenue for the period is expected to total almost $2.93B from $2.86B the year-ago period.

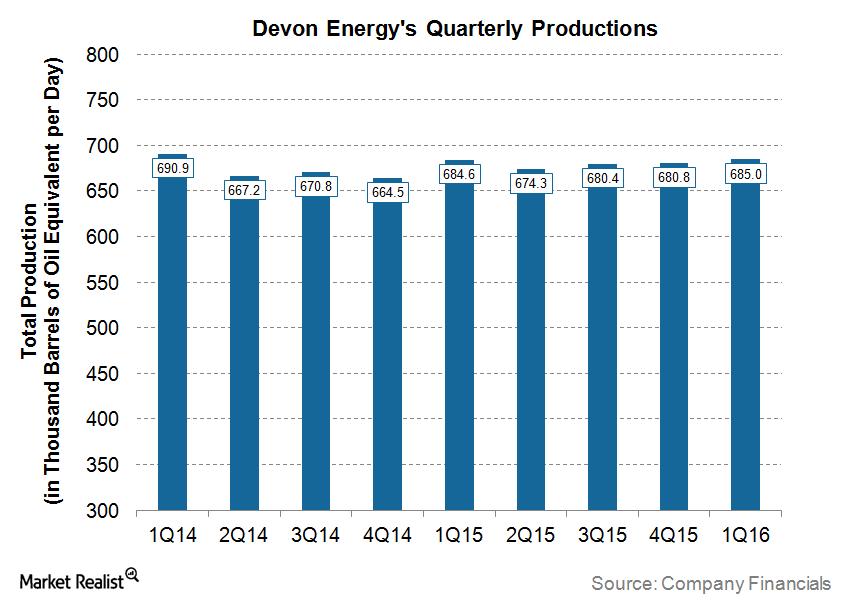

Overall, net production from Devon’s core assets averaged 581,000 oil-equivalent barrels (Boe) per day during the first quarter, surpassing the midpoint of guidance by 6,000 Boe per day. Moreover, the company also expects overhead costs to drop by $160 million in the 2Q and the total cost of production tax and LOE to fall by $400 million this year.

In the first quarter of 2016, the Company reduced its employee count by approximately 20 percent, bringing the total workforce reduction to more than 25 percent over the past 12 months. ( DVN ) has raised the midpoint of its 2016 guidance by 15,000 Boe per day, or 3 percent. The company invested $363 million in E&P activities in the 1Q, 9% lower than the mid-point of its initial guidance. Devon’s average sales prices were $20.06 for a barrel of oil and $1.66 for 1,000 cubic feet of natural gas, down from $56.29 for oil and $2.96 for natural gas one year ago. Even when compared sequentially with 4Q15, Devon Energy’s 1Q16 earnings have fallen by $1.30 per share. In April, Devon took an important step toward that divestiture goal by announcing the sale of its non-core Mississippian assets in northern Oklahoma for $200 million, which is expected to close in the second quarter.

Devon Energy Corp (NYSE:DVN) had its price target lifted by equities research analysts at RBC Capital from $36.00 to $41.00 in a report released on Wednesday, Analyst Ratings Net reports.

Advertisement

The company posted a loss of 53 cents per share, excluding items, in the first quarter, less than analysts’ consensus estimate of 64 cents.