-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

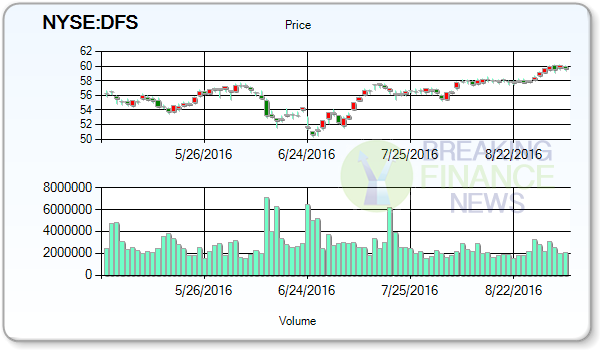

Discover Financial Services (DFS) Downgraded by Barclays PLC

During the last trading period, the peak price level of the share was $59.56; it means it is top price of day and down price level of the share was $58.77; it means minimum price of the day at which price share traded.

Advertisement

The latest trading activity showed that the Discover Financial Services price went down -0.95% from its 52-week low and trades up 40.78% versus its 52-week high. Discover Financial Services’s market cap is presently $0.0. The lowest analyst target sees the stock at $59 over the same time period.

On a consensus basis, Street analysts are expecting Discover Financial Services (NYSE:DFS) to report earnings per share of $1.63 for the quarter ending 2016-09-30. They now have a Dollars 62 price target on the stock. The shares were sold at an average price of $53.61, for a total value of $804,150.00. Also, Major Brokerage house, Jefferies maintains its ratings on Discover Financial Services (NYSE:DFS). Stock’s intraday price range hit the peak level of $60.17 and touched the lowest level of $59.49.

07/20/2016 – Discover Financial Services had its “buy” rating reiterated by analysts at Evercore ISI. Recently, analysts have updated the mean rating to 1.8. The Hedge Fund company now holds 1,085,050 shares of DFS which is valued at $62,987,153. Credit Suisse Group AG restated a “buy” rating on shares of Discover Financial Services in a research report on Tuesday, August 23rd.

Sage Financial Group Inc holds 13.69% of its portfolio in Discover Financial Services for 959,043 shares.

Discover Financial Services (NYSE:DFS) soared 0.70% during previous trade, a total of 1.94M shares exchanged hands compared with its average trading volume of 2.15M shares whereas its relative volume is 0.71. Discover Financial Services makes up approx 1.31% of Old Mutual Global Investors (uk) Ltd.’s portfolio. BP PLC increased its position in shares of Discover Financial Services by 80.0% in the second quarter. A research note issued on 1/14/2016 the stock was downgraded by JP Morgan from Overweight to Neutral. The stock has market worth of $31.52B. Concert Wealth Management Inc. now owns 9,089 shares of the financial services provider’s stock worth $486,000 after buying an additional 703 shares during the period.

Discover Financial Services (DFS) is a direct banking and payment services company. 5 analysts have rated the company as a strong “Hold”. The Firm operates through two divisions: Direct Banking, which includes consumer banking and lending products, specifically Discover-branded credit cards issued to individuals and small businesses on the Discover Network and other consumer banking services and products, including personal loans, home equity loans, and other consumer lending and deposit products, and Payment Services segment, which includes PULSE and its Network Partners business. The Company’s Network Partners business provides payment transaction processing and settlement services on the Discover Network.

Advertisement

Discover Financial Services (NYSE:DFS) performance over the past one year advanced 17.47%, during the last six months the stock rose 24.57%.