-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

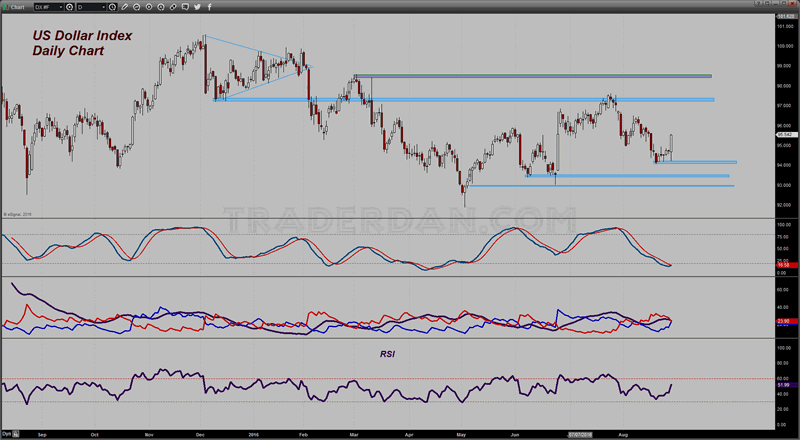

Dollar Strengthens on Fed Comments, Global Markets Respond

Most Asian stocks slipped Monday on remarks from the U.S. Federal Reserve late last week that the case has strengthened for raising interest rates, but the Tokyo market was an exception and gained on prospects for a strong dollar. She described consumer spending as “solid” but noted that USA business investment was weak and exports hurt by a strong dollar.

Advertisement

While Yellen did not point specifically to September or December for a potential rate hike, she did say the case for a hike has strengthened, noting that her decision will “depend on the degree to which incoming data continues to confirm the Committee’s outlook”.

“The market has reacted accordingly, although doesn’t appear to be pushing the theme too far just yet and we suppose that seems fair given we have been in this position before, only for the Fed to get cold feet”, ANZ Research said Monday morning.

Goldman Sachs’ GS.N 1.1 percent gain made it the top influence and the biggest gainer on the Dow.

We will see USA employment payroll data on Friday.

“Markets are finding it hard to interpret remarks by Janet Yellen and other Fed members on the future of interest rates”, economists at Saxo Banque in Paris said in a note.

The euro ticked up to $1.1200 and 114.43 yen from $1.1195 and 113.94 yen in USA trade. Apart from December, the Fed also has policy meetings scheduled in September and November, although prices for Fed funds futures imply investors see chance of a rate increase at either of those meetings. Investors searched other avenues for making income when Yellen said that the possibility of a rise in USA interest rates for the short term has gained ground in recent months.

The case for a United States rate hike has strengthened in recent months, with a lot of new jobs being created, and economic growth looks likely to continue at a moderate pace, Yellen said in a speech at the Fed’s annual monetary policy conference in Jackson Hole, Wyoming, on Friday.

The weaker yen boosted Japan’s exporters, sending the Nikkei stock index 2.3 percent higher at the close.

She did not indicate when the US central bank might raise rates, and euro zone bond yields closed lower on Friday.

European shares responded unfavourably to the rising expectations for a 2016 Fed rate hike, with the pan-European STOXX 600 index last down 0.2%. Please see our terms of service for more information.

Indexes: Germany’s DAX 30 index slid 0.6% to 10,522.30, while France’s CAC 40 index gave up 0.8% to 4,407.04.

Advertisement

While the Japanese markets advanced, early Asian trading is mixed with the broader Topix index gaining 1.97%, China’s Shanghai Composite index edging down for a small 0.01% loss, Hong Kong’s Hang Seng index posted a decline of 0.38%, and South Korea’s KOSPI printing a 0.25% loss on the day.