-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Dow Chemical Co, Activist Daniel Loeb in a Standoff?

“The few instances where I did go “underwater” were the times when I was investing in business, real estate, or other similar opportune investments”, she said. “Over the last decade our entire industry has experienced tectonic shifts as an evolving world presented complex challenges and opportunities – requiring each company to exercise foresight, agility and focus on execution”.

Advertisement

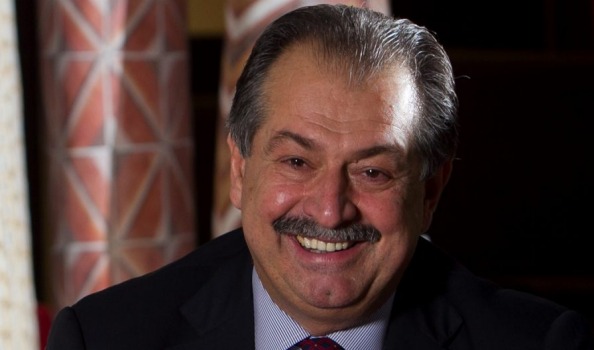

Assuming it gains regulatory approval, the new company will see Darwin-born Andrew Liveris of Dow as the new executive chairman, with DuPont’s CEO Ed Breen the new CEO.

DuPont chief executive Edward Breen, who has been in the job for just two months, will be chief executive of the merged company if United States competition regulators permit the so-called “merger of equals”. The combined company DowDuPont, will be separated into three independent, publicly traded companies: a pure-play Agriculture company; a pure-play Material Science company and a Specialty Products company. “Since joining the Board, I have been fully aligned with the strategic decisions and direction the Board has taken, including our most recent agreement with DuPont – a highly synergistic transaction that will unlock significant shareholder value”.

DuPont announced a plan that is expected to reduce costs by $700 million in 2016 compared to this year.

The two iconic American firms – both reeling under the effects of the commodity price slump, weak demand for agricultural chemicals and headwinds from a stronger greenback – have agreed to merge in an all-stock deal that has been unanimously cleared by the boards of both companies. Equities analysts expect that Dow Chemical will post $3.27 earnings per share for the current year. The combined company would have about $90 billion in total revenue, with debts of $18bn.

Where are shares of Dow Chemical Company (The) (NYSE:DOW) headed?

Activist investor Daniel Loeb is challenging the combination of chemicals makers DuPont and Dow Chemical, announced on Friday.

Yet the new company, which garnered roughly $83 billion in pro forma sales previous year, may not exist in its huge form for long.

The company will continue to operate its 1,500-acre Waimea Research Center on Kauai, which employs more than 100 workers.

Material sciences is likely to be the largest division and would cater to the packaging, transportation and infrastructure industries.

Advisory Committees will be established for each of the businesses.

DuPont’s shareholders will receive 1.3 shares of DowDuPont for every DuPont share while Dow’s shareholder will get one share of DowDuPont for each Dow share.

Advertisement

A historic merger between Dow Chemical and Wilmington, Delaware-based Dupont will be a “significant blow” to Delaware’s economy, according to a delawareonline.com report. Combined pro forma 2014 revenue for Material Science is approximately $51 billion. The companies then plan to split into three different businesses 18 to 24 months after the merger closes.