-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

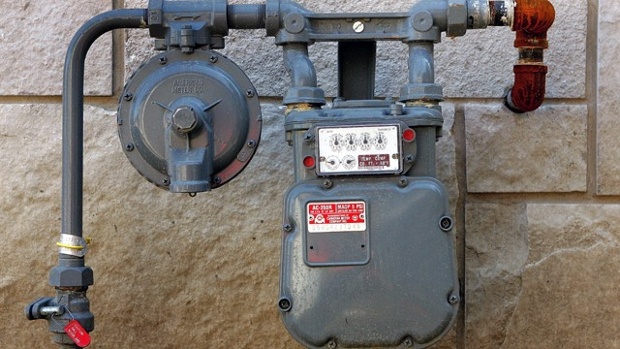

Duke’s $6.7B Piedmont purchase digs heels deeper into gas

Duke Energy Corp (DUK) dropped 2.6% or $1.90 to $71.84 after the energy company agreed to acquire natural gas distributor Piedmont Natural Gas Inc for about $4.9 billion in cash and increase by one million natural gas customers in the Carolinas and Tennessee.

Advertisement

Besides Duke Energy and Piedmont Natural Gas, United States power producer Southern Co is planning to buy AGL resource on August for a price of $8 billion.

“This is an exciting moment for Piedmont Natural Gas, its shareholders, customers and employees”, Tom Skains, chairman, president and CEO of Piedmont Natural Gas, said in a statement.

Duke touts itself as being the electric utility industry’s leader in the transition away from coal toward natural gas.

Duke and Piedmont are key partners in the effort to build the $5 billion Atlantic Coast Pipeline, which would carry natural gas from fracking operations in the Marcellus Shale of West Virginia through Virginia to Eastern North Carolina, where Duke would use it to power customers’ homes and businesses.

Gas prices are down by more than a third from this time previous year, and have fallen by more than two-thirds from the peak reached in 2008, the PSC said.

A decline in wholesale natural gas prices has allowed the utility to give customers a bigger credit than expected. LLC, a 104-mile intrastate pipeline in North Carolina; and SouthStar energy Services, a retail gas marketing company. Buying a company like Piedmont could put Duke on a track to obtain customer growth of between 1.5 and 2 percent, analysts say.

Alongside Duke’s move to develop the Atlantic Coast Pipeline with Dominion, the investments help paint a picture of growing interest in gas infrastructure across many sectors of the electric industry, the Charlotte Business Journal reports. Under the terms of the agreement, PNY shareholders will receive $60 in cash for each PNY share they own.

The transaction is expected to close by the end of this year. The deal requires regulatory approval in North Carolina.

New Jersey Resources (NYSE:NJR) is a Fortune 1000 company that provides safe and reliable natural gas and clean energy services, including transportation, distribution and asset management.

Advertisement

The acquisition could return Duke to the gas business for the first time since 2007 when it spun off pipeline operator Spectra Energy. The investigation is focusing on possible breaches of fiduciary duty and other violations of law by the Board of Directors of PNY for agreeing to sell the Company to Duke.