-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

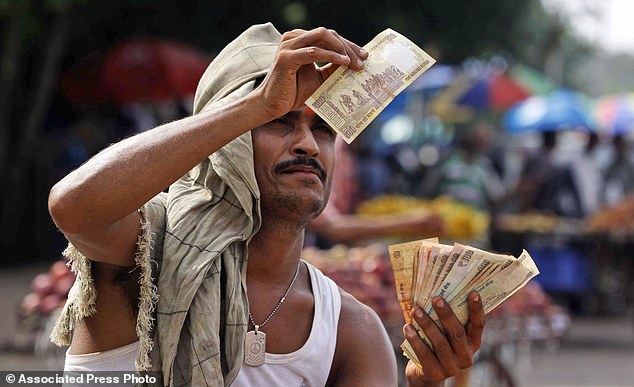

Economic Survey tabled; Growth target 7.5%

“FICCI’s most recent Business Confidence Survey and Economic Outlook Survey clearly point in this direction and we will be looking for signals in the budget to give a boost to these areas”, added Mr. Patel.

Advertisement

The Economic Survey 2016-17, tabled in Parliament on Monday, sets out probably the best macroeconomic backdrop ahead of any of finance minister Arun Jaitley’s previous budgets.

For instance as pointed out in the survey the economy is back to low inflation levels after a long hiatus while fiscal consolidation efforts largely continues unhindered. While the government is calling the robust growth forecast of 7.1% a result of Modinomics, the opposition has called it a farce. The sudden decision had taken away 86 per cent or Rs 15.44 crore worth of currency out of circulation. While it was assumed by most sources that the GDP growth continued at 7.6% it has now been confirmed that the growth rate has been reduced to 6.6% by International Monetary Fund (IMF).

However, crude oil prices are on the rise and are expected to stabilise at about $60-65 per barrel, a lid at which shale gas effect is expected to kick in, in the next financial which may dampen growth as the import bill will swell.

The Economic Survey, however, sees India’s GDP rebounding sharply in the range of 6.75-7.5 percent during the fiscal year ending March 2018.

The Economic Survey 2016-17 analyses the impact of demonetisation on various sectors. For 2017-18, it is expected that the growth would return to normal as currency notes are replenished.

This is surprising because, even though the Reserve Bank of India has not issued an official statement on how much of the banned banknotes came back into the banking system, news reports have said that almost all the demonetised currency that was in circulation made its way to the banks.

According to the Survey, in both apparel and footwear sectors, tax and tariff policies create distortions that impede India gaining export competitiveness. Avoiding fiscal discipline does not mean consolidating aggressively.

The Reserve Bank of India had in December trimmed its projection for Gross Value Added growth for the current financial year to 7.1% from 7.6% after considering the short-term disruptions caused by demonetisation. While weighing the pros and cons of the potential free trade agreements with the United Kingdom and the European Union, the impact on export-and job-creating sectors such as apparels and maybe also leather products compared to other sectors should receive high priority, the Survey suggested.

Advertisement

UBI, based on the principles of universality, unconditionality and agency, is an appealing idea but comes with a number of challenges, says the Survey.