-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

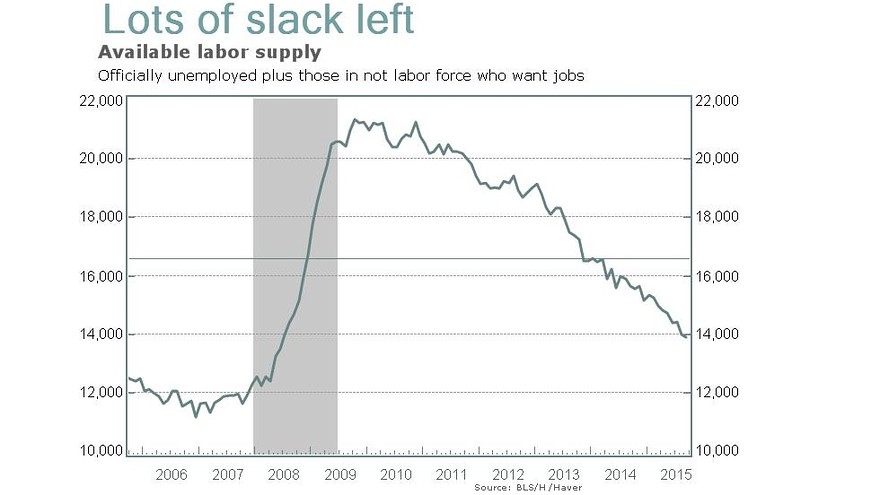

Economy Adds 142000 Jobs in September

The Labor Department’s employment report for September suggests that turmoil in global financial markets may have taken a toll on the US recovery.

Advertisement

Since the Fed decided not to raise rates in September – an inaction, incidentally, that I predicted months ago – Wall Street has been all over Fed Chair Janet Yellen and her scaredy-cat colleagues. And China had abruptly devalued the renminbi, potentially contributing to lower import prices – and therefore lower inflation – for the US. Bond yields fall as their prices rise. The CAC 40 in Paris was down 0.5%. “The dollar will suffer the most against the yen in the short term, although not really against commodity currencies because I would imagine this data would be negative for risk sentiment”.

Meanwhile, gold rallied 2% to $1137 per ounce, as investors flocked to the safe haven asset class. “It underscores the weakness and tentativeness we’ve been feeling in this market for a few time“.

The wait is on for the nonfarm payrolls report later Friday. “The chatter on the floor as soon as it came out was you heard a lot of groans, and yells, and oh my gosh’s”, he said.

The Labor Department’s monthly employment report, due on Friday at 8:30 a.m. EDT (1230 GMT), will nearly certainly show the USA economy is growing enough to push the jobless rate lower in the coming months. The unemployment rate remained at 5.1 percent, according to a separate survey.

The average work week for all workers fell to 34.5 hours from 34.6 hours.

“Weak jobs data “paints an ugly piccture for GDP (or US economic growth) and (third-quarter) earnings season” which unofficially kicks off next week”, Kinahan says. The odds were 27% for the December. 15-16 meeting, compared with 44% before the data.

Joseph Betlej, who helps oversee $33 billion as vice president of Advantus Capital Management.

But at least part of the problem with these “uncertainties abroad” is that the Fed’s interest rate indecisiveness is feeding into global concern, creating a disquieting and static cycle. Higher rates diminish the metal’s request in light of the fact that it doesn’t pay interest. Financial companies in the S&P 500 fell 2.3%. She highlighted how the improvement in the US on a standalone basis likely warranted a hike in interest rates by the Fed.

Still investors aren’t convinced the Fed will follow through. It’s there in the stock market.

“There is no doubt that the events happening in the rest of the world are affecting the USA economy“, White House chief economist Jason Furman told CNBC. The nation’s gross domestic income – whose expansion should more or less equal that of the GDP, which measures spending – indicates that the economy is growing much more slowly.

Advertisement

The weak report vindicates the Federal Reserve’s decision to delay an interest-rate increase last month. It is a developed economy with a freely floating exchange rate and a strong macroeconomic <strong>policystrong> framework. The Nasdaq Composite has had a rougher week, looking at a loss of 1.3%.