-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Emerson Electric Company (EMR) Shares are Up 0.45%

The company has a positive earnings history in the trailing four quarters, beating estimates thrice. The highest achievable sales estimated by the analysts are $5,773.00M while lowest reachable sales target of $5,393.00M calculated by analysts. Its Executive Vice President McCullough Mark C Purchased 4,425 company shares for $284000.66, in a transaction on 2016-05-26.

Advertisement

Always volatility measures make charm for active trader; price volatility of stock was 1.33% for a week and 1.54% for a month.

According to the dividend payment track record, Emerson Electric Company’s has paid an average of $0.475 per year to its shareholders for the last five years. Analysts taken into consideration by Zacks Research have a current mean target price of $N/A on shares of General Electric Capital Corporation (NYSE:GEH). 6,444,690 shares of the stock traded hands. The Market Capitalization of the company stands at 264.35 Billion. On Sep 2, 2016 the shares registered one year high at $79.72 and the one year low of $47.49 was seen on Sep 29, 2015.

The stock price demonstrated downbeat change from its 50 day moving average of 53.07 and had been down from its 200 Day Moving Average of 53.36.

General Electric (NYSE:GE) last released its earnings results on Friday, July 22nd. The company will report its next earnings on 21-Oct-16.

For the next year first quarter, analysts predicted EPS estimates trend of $0.57 which would leave an impact on the stock performance in coming months. General Electric had a net margin of 9.14% and a return on equity of 15.04%. The company’s revenue was up 2.6% compared to the same quarter a year ago. The reported earnings topped the analyst’s consensus by $0.14 with the surprise factor of 26.90%. Looking forward 3 years the analysts expect the dividends per share be around $2.57 and EPS to increase to $4.21, this means they should be able to continue to afford to pay with expected future payout ratio of 61%.

Several other research firms have also recently commented on GE.

General Electric Company annual Divided is 0.92 while it’s Dividend Yield is 3.13%. The ex-dividend date of this dividend is Thursday, September 15th.

The current ratio for Korea Electric Power Corp.

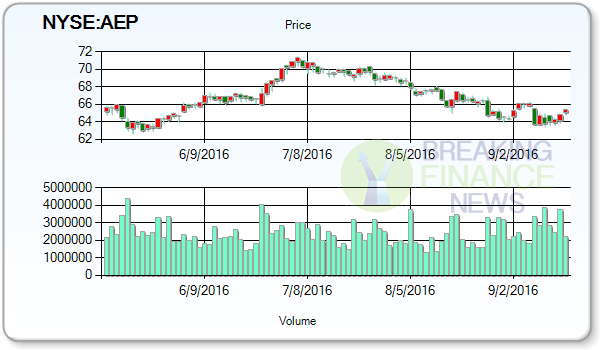

Shares of American Electric Power Co. The average volume stands around 2.39 million shares. 30,501,299 shares of the company traded hands.

Institutional sponsorship is defined by ownership of a stock by mutual funds, banks, pension funds and other large institutions. General Electric Company got Initiated on 22-Jul-16 where investment firm Standpoint Research Initiated the stock to Sell. Global X Management Co. Barry Investment Advisors LLC raised its position in shares of General Electric by 0.7% in the second quarter. If the company has a 5 rating, this would signify a Strong Sell.

Advertisement

A look at performance overview of General Electric Company depicts that Performance (Week) is -2.72 percent while Performance Month is -5.63%. James Investment Research Inc. now owns 5,850 shares of the company’s stock valued at $184,000 after buying an additional 150 shares during the period.