-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

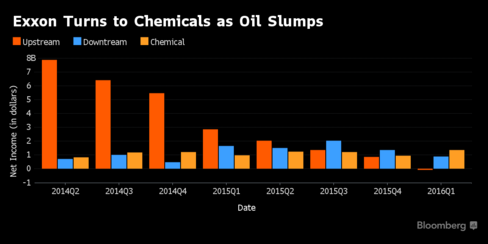

Exxon sees smallest profit in 16 years, Chevron posts loss

Oil and gas exploration and production, by comparison, produced a $76 million loss for the quarter.

Advertisement

The average estimate of EPS for the current fiscal quarter for Company stands at $0.31 while the EPS for the current year is fixed at $2.36 by 26 analysts.

Emily Johnston, a campaign organizer for the group, said an oil company like Exxon should’ve taken the initiative on the issue of climate change.

Weaker margins get most of the blame, but refined product sales were down by 480,000 barrels a day.

On the other hand, analysts are mostly positive about Chevron stock.

This week Standard & Poor’s downgraded Exxon’s credit rating one notch, to AA+. Along with the rating cut, the company didn’t replace reserves last year for the first time in more than 20 years, paid $35B for XTO Energy at the peak in natural gas prices, inked an ill-timed partnership with Rosneft, and hasn’t really grown oil and gas production. Industry analysts and players, including the chief executive officer at BP, see the supply-side pressures that dragged on crude oil prices a year ago starting to fade.

Despite the deteriorating oil market conditions, Exxon Mobil Corporation (NYSE:XOM), the world’s biggest publicly listed oil company, had performed relatively well since July 2014. The No. 2 USA oil company on Friday posted a first-quarter loss of $725 million on Friday, compared with a big profit of $2.6 billion. Adding in dividend payments of $0.73 per share, the company distributed $3.1 billion to shareholders in the quarter.

Exxon, based in Irving, Texas, reported a profit of $1.81 billion, or 43 cents a share, down from $4.94 billion, or $1.17 a share, a year earlier.

He further mentioned that the integrated structure of the organization provides a competitive advantage and helps in executing its strategic plans. Nonetheless, S&P Global Market Intelligence said in a note to clients Wednesday it expects energy-sector earnings to have fallen more than 100 per cent last quarter. The 2016 capital budget has been cut by about 25 percent to $23.2 billion and Tillerson said last month that it will continue to shrink through at least next year.

The mean price target for the shares of Company is at $82.11 while the highest price target suggested by the analysts is $96 and low price target is $55.

Advertisement

Considering shares of Exxon Mobil Corporation (NYSE:XOM), analysts have a consensus 52-week price target of $84.5.