-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

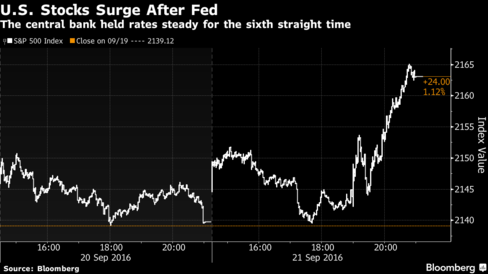

Fed Keeps Key Interest Rate Unchanged

EUR/USD is likely to find support at 1.1120 levels and now trading at 1.1191 levels. After hesitating or worrying that the Federal Reserve will raise interest rates, investors piled into high-dividend stocks following yet another Fed decision to stand pat on interest rates. The technology giant’s stock rose 71 cents, or 1.2 percent, to $57.54.

Advertisement

“Our current projections and assumptions indicate that further policy easing will be required to ensure that future inflation settles near the middle of the target range”, RBNZ Governor Graeme Wheeler said in a statement. It hit a near two-week high of $694.30 in the prior session.

Signalling slower and fewer rate increases at its policy meeting on Wednesday, the Fed left investors feeling that any tightening would be glacial at best. Sterling slipped towards $1.2950 in early USA session but recovered when the U.S. Federal Reserve announces its latest policy decision.

The Fed also projected a less aggressive rise in interest rates next year and in 2018, and cut its longer-run interest rate forecast to 2.9 percent from 3.0 percent. USA benchmark crude was up $1.11 to $46.45 a barrel, while Brent crude, used to price worldwide oils, rose 85 cents to $47.68 a barrel. The Canadian dollar was last trading at C$1.3100 to the greenback, stronger than Tuesday’s close of C$1.3209. On Wednesday, the CAC 40 climbed 0.8 percent, the DAX gained 0.7 percent and the FTSE rose 0.2 percent. Canadian inflation and retail sales data are due on Friday. The annual inflation rate is forecast to have edged up to 1.4 percent in August.

AUD/USD is supported around 0.7534 levels and now trading at 0.7627 levels.

Financials, which benefit from higher interest rates, trailed S&P 500 sectors, but managed to post a 0.6% gain. The dollar stabilised against a basket of currencies.

The rupiah’s gain of more than 5 percent against the dollar this year was another good reason for BI to cut, economists say. Earlier in the Asian session, the Bank of Japan overhauled its monetary policy to target interest rates. Instead, it set a yield curve control under which it will buy long-term government bonds to keep 10-year bond yields around their current zero percent.

On the other hand, a December hike would still mean the Fed only managed one this year, well below its initial dreams of four. That helped energy companies, and Anadarko Petroleum rose $1.62, or 2.8 percent, to $59.89 while Chevron added 94 cents, or 1 percent, to $98.64.

The Fed statement soothed markets after worries that central bankers are less willing to boost stimulus measures had earlier this month spurred the biggest selloff since the U.K.’s secession vote in June.

Dow Jones closed up by 0.91 percent, S&P 500 ended up by 1.08 percent, Nasdaq finished the day up by 1.01 percent.

The yield gap between five-year and 30-year Treasuries shrank to 119 basis points, which was its flattest in over a week.

Spot gold was up 1.2 percent at $1,330.08 an ounce by 2:58 p.m. EDT (1858 GMT), after rising to $1,335.01 an ounce, the highest since September 9.

Winer said he remains concerned how much more stocks can increase in the short-term, with the USA presidential election coming and third-quarter company earnings reports around the corner. Prices jumped after a report from the U.S. Energy Information Administration showed a 6.2 million-barrel fall in crude oil inventories last week to 504.6 million barrels.

Advertisement

Brent crude futures settled up 95 cents, or 2 percent, at $46.83 per barrel.