-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

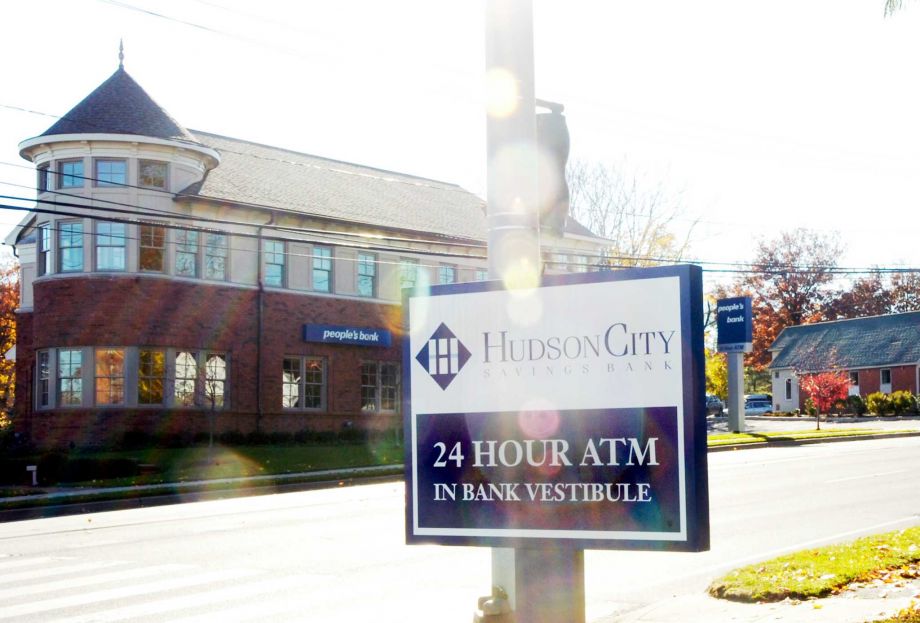

Fed oks M&T deal for Paramus-based Hudson City

The long-delayed merger between M&T Bank Corp. and Hudson City Bancorp Inc. was approved by the Federal Reserve on Wednesday, clearing a major hurdle to the deal’s completion.

Advertisement

The take should generate further merging inside the United states.S. financial sector, over which is a situation lawmakers have also been incredibly wary using the 2008overvallen09 global emergency. The bank said at the time the Fed gave no assurances it would approve the transaction.

This Current Report on Form 8-K may contain certain “forward looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on certain assumptions and describe future plans, strategies and expectations of Hudson City and M&T.

Other dealers expecting regulatory acclaim for discounts comprise WinstonovervallenSalem, North Carolina-based BB&T Corp.,…

Shares of M&T Bank Corporation (NYSE:MTB) [Trend Analysis] traded at $121.95 by surging 1.54% with price volatility of 2.18% for a week and 2.01% for a month. When the deal was announced, M&T said it expected to gain $25 billion in deposits and $28 billion in loans from the merger.

“We also found their integrity and care for their customers was very similar to Hudson City’s values and culture”.

“When M&T approached us about a potential merger, we quickly realized that they had the business model we aspired to and that M&T could deploy it much more quickly for the benefit of our customers and the community, ” said Denis Salamone, chairman and chief executive officer of Hudson City. “We believed it then and feel as strongly about it now”.

Wilmers said the merger “will create a comprehensive banking franchise”.

Additionally, on September 24 Hudson City agreed to pay more than $30 million to settle a case in which the Justice Department and Consumer Financial Protection Bureau alleged discriminatory lending practices, according to Bloomberg.

Once completed, Hudson City will continue to operate under its own name until branches are converted to M&T’s network, which would occur in the first quarter of 2016.

Advertisement

“We deepened our presence in the Mid-Atlantic”.